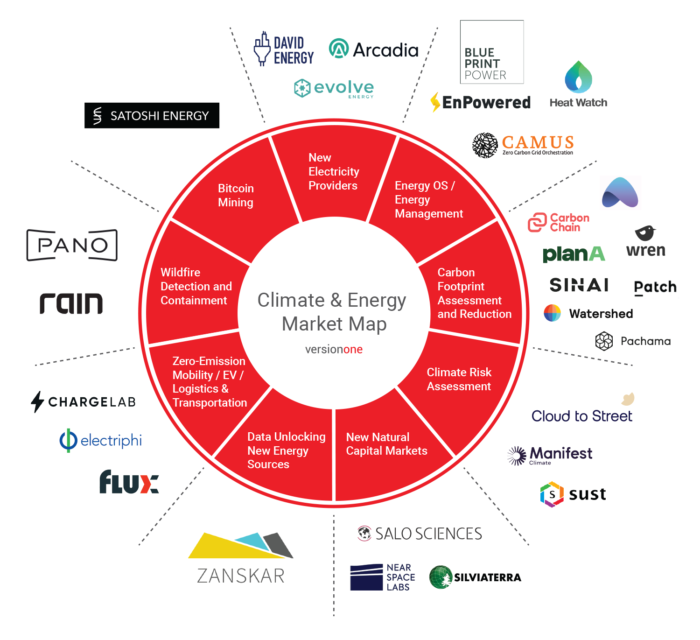

Areas of interest in climate & energy

Energy/ClimateOver the past 18 months, we’ve been increasingly focused on investing in climate and energy startups.

Public awareness about sustainability and climate change is at an all-time high. There are strong tailwinds on the renewable energy front as Max discussed this summer: the cost of solar is falling off a cliff; storage and EVs are falling down similar cost curves; we’re seeing innovation in financial engineering and the rise of smart grids and smart homes, etc. For all these reasons, we are very excited about the many opportunities for software to solve our planet’s climate crisis.

Disclaimer: By no means is the above market map comprehensive. It only lists software companies in the climate and energy space that have come across Version One’s radar recently.

Some of our particular themes and areas of interest include (* indicates a Version One portfolio company):

New Electricity Providers

As grids become increasingly dominated by Distributed Energy Resources (DERs) like solar, wind, batteries, and EVs, and customer preferences continue to shift toward clean energy, a new wave of utilities and electricity providers will emerge. Some companies in this category: Arcadia Energy, David Energy, Evolve Energy.

EnergyOS / Energy Management

As industrial customers (offices, manufacturing plants) and buildings become increasingly intelligent and host their own DERs, they too will need to speak directly with the grid and other providers of electricity and storage. Some companies in this category: Blueprint power, Camus Energy, EnPowered*, Heat Watch.

Carbon Footprint Assessment and Reduction

With shifting consumer preferences and government regulations looming, entire industries will need to assess their carbon footprints and take action to mitigate it. Some B2B companies: CarbonChain, Plan A, SINAI Technologies, Watershed; consumer startups: Aerial, Wren; and negative emission platforms: Pachama, Patch* (read our investment announcement here).

Climate Risk Assessment

As the impacts of climate change begin to manifest, industries like finance and insurance will need to better assess risk profiles from rising sea levels, stronger storms, floods, and wildfires. Some companies in this category: Cloud to Street, Manifest, Sust Global.

New Data Sources + Machine Learning = New Natural Capital Markets

The emergence of cheaply available satellite data and advanced machine learning unlocks entirely new natural capital markets. Some companies in this category: NearSpaceLabs, Salo Science, SilviaTerra* (read our investment announcement here).

Data Unlocking New Energy Sources

New data sources and machine learning will unlock previously unfeasible electricity generation from newly available geothermal sites. Perhaps other sources like tidal will one day follow. A company in this category: Zanskar.

Zero-Emission Mobility / EV / Logistics & Transportation

The rapid rise of EVs will be one of the biggest stories of this decade and there will be tremendous need for software to manage grid interaction, optimize storage, operate fleet networks, and facilitate financing. Some companies in this category: ChargeLab, Electriphi, Flux Auto.

Wildfire Detection and Containment

Wildfire risk strikes close to home for us at Version One and we’re hopeful to see the rise of companies that can effectively predict and combat them. Some companies in this category: Pano AI, Rain.

Bitcoin Mining

As Proof of Work (PoW) cryptocurrency networks like Bitcoin continue to gain prominence, there will be numerous opportunities to use miners as flexible load that can unlock further deployment of DERs. You can read our post on the solar-bitcoin convergence. A company in this category: Satoshi Energy.

As you can see, this list is long and diverse. And that’s important, as addressing climate change will require taking a multifaceted approach. If you’re working in this space, please reach out to us! We look forward to hearing from you!