There’s a talent drain facing the tech industry today. We frequently hear about companies that…

Energy/Climate

As our planet is grappling with a climate crisis and dependence on fossil fuels, we are investing more and more in climate and energy. In less than two years, we’ve led the pre-seed/seed rounds of five companies: EnPowered, Patch, NCX, one yet to be publicized, and now EnergyBank. And we are excited to spread the […]

There’s a talent drain facing the tech industry today. We frequently hear about companies that…

We are very happy to announce our investment in Manifold, the easiest way to find…

As our planet is grappling with a climate crisis and dependence on fossil fuels, we are investing more and more in climate and energy. In less than two years, we’ve led the pre-seed/seed rounds of five companies: EnPowered, Patch, NCX, one yet to be publicized, and now EnergyBank. And we are excited to spread the news of their raise today.

EnergyBank is on a mission to accelerate the uptake of renewable energy. Currently, there is an abundance of low-cost renewable sources like solar and wind, but it’s difficult to control the timing and certainty of energy supply from these sources. You can’t dictate when the wind blows or the sun shines. That means energy storage is key. And EnergyBank is developing a novel, deep ocean gravitational energy storage technology that can store excess renewable energy during periods of oversupply, and then supply this energy back into the grid during shortages.

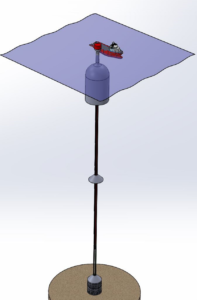

What does this technology look like? The team is building a large floating device (picture of the concept below) that can move masses of water from the ocean floor to its surface (over vertical distances between 4-8km) in order to exploit the gravitational potential energy. This process requires no land, has little accident risk, is scalable and lower-cost compared to Lithium-Ion batteries. In fact, this floating device that costs $16M can provide potential energy equivalent to $1-2B worth of Lithium-Ion batteries! And with 60% of the planet’s surface more than 4km underwater, the solution can apply to more than 40 countries.

EnergyBank may not look like the typical Version One investment. However, this is such a unique clean energy solution with mission-driven founders, that we had to back the team as they work on technical and industrial viability.

EnergyBank is led by Tim Hawkey, Rhys Foster and Jordan Hooper. The team is based in New Zealand (reminder: we’re investing worldwide now!) and we’re excited about building new friendships with a collection of VC firms from down under, including Icehouse Ventures (who led the seed round) and Blackbird.

Portfolio, Version One

Last-mile delivery is one of those markets that looks simple at first glance—until you dig in and realize how much of it is held together by workarounds. As quick commerce scales across India, delivery volumes are exploding. Companies want to deliver more. But the vehicles powering those deliveries haven’t really kept up. Most are still […]

There’s a talent drain facing the tech industry today. We frequently hear about companies that…

We are very happy to announce our investment in Manifold, the easiest way to find…