Chris Fralic's tweet about a board meeting best practice this morning got me thinking that…

Entrepreneurship

I recently wrote about how to build an ideal investor base if you find yourself in the fortunate position of being oversubscribed in the round you are currently fundraising for. In that post, I mentioned “help in hiring” as a quality that might be potentially valuable to you when considering the right investors. When we talk […]

Chris Fralic's tweet about a board meeting best practice this morning got me thinking that…

As you’re building your marketplace, consider which tools and technology to leverage. There’s no reason…

I recently wrote about how to build an ideal investor base if you find yourself in the fortunate position of being oversubscribed in the round you are currently fundraising for. In that post, I mentioned “help in hiring” as a quality that might be potentially valuable to you when considering the right investors.

When we talk about a VC’s role in hiring, we typically are referring to two things: 1) recruiting from the VC’s network and 2) evaluating skills / assessing fit for a role. The latter is particularly useful if you’re hiring for a position that you haven’t hired for before. But there’s a third way in which an investor can be helpful and that’s being a strong voice to help close a candidate once the offer is made.

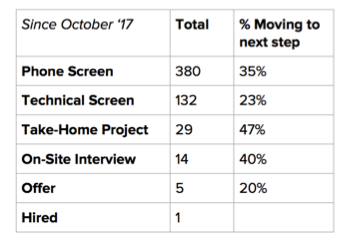

Hiring for the right skill set and cultural fit is hard, and it’s made all the more difficult in a competitive environment where great candidates have multiple opportunities to choose from. For instance, at a recent board meeting, one of our portfolio companies shared its hiring funnel for engineers.

I wouldn’t be surprised if most funnels resembled this… so how can we improve the drop off from “Offer” to “Hired”?

One strategy is to recommend that a candidate speak to one of your investors. Reassure the candidate that the investor will not be evaluating his or her skill, but rather, is available to answer any questions and address any concerns around you as a founder, the company, the market, and the competitive landscape.

Now the challenge: not every investor is appropriate for this task.

You obviously want a champion but also someone who has a good pulse on your business and your team, and not just a 35000 ft. view. Typically, this is an investor you trust and speak to often (i.e. more than once a month). In particular, the right investor:

After a startup raises money, hiring is usually the next big challenge. Involving your investor during the closing process might just be the final nudge needed to bring candidates onboard.

Portfolio, Version One

Last-mile delivery is one of those markets that looks simple at first glance—until you dig in and realize how much of it is held together by workarounds. As quick commerce scales across India, delivery volumes are exploding. Companies want to deliver more. But the vehicles powering those deliveries haven’t really kept up. Most are still […]

There’s a talent drain facing the tech industry today. We frequently hear about companies that…

We are very happy to announce our investment in Manifold, the easiest way to find…