Over the past 18 months, we’ve been increasingly focused on investing in climate and energy…

Energy/Climate

It’s been exciting to see so much renewed investor interest in climate tech and clean energy startups. As Peter Thiel documented in detail, the last wave of late 2000s cleantech VC excitement ended in a trough of despair as many of the more well-funded companies went bust (with the notable exception of a few big […]

Over the past 18 months, we’ve been increasingly focused on investing in climate and energy…

Earlier this year, I published a post that was very bullish on an emerging electricity…

It’s been exciting to see so much renewed investor interest in climate tech and clean energy startups. As Peter Thiel documented in detail, the last wave of late 2000s cleantech VC excitement ended in a trough of despair as many of the more well-funded companies went bust (with the notable exception of a few big winners like Tesla, SunRun, and Opower). As someone who spent the better part of the last decade building startups in the solar and energy efficiency industries, I can attest that there are indeed many challenges to building a scalable cleantech business: it’s inherently more difficult to move atoms than bits, energy markets are heavily regulated and vary greatly from geography to geography, and upfront capital costs are generally expensive and require sophisticated, patient project finance.

Given that these challenges are still very much present, the obvious question becomes: why now? What has changed that’s made the field attractive again to VCs hoping to generate >10x returns? In my opinion, this time is indeed different and the opportunities to build venture scale outcomes are numerous. Let’s explore why. (Note: in this post, I’ll focus specifically on the energy industry. We’ll explore other climate tech in future posts).

1) The cost of solar has fallen off a cliff

It’s been shocking to see how few people understand what’s happened with the cost of solar energy over the last decade and the impacts it will ultimately have on society. Depending on the data source, the unsubsidized Levelized Cost of Energy (LCOE) of solar in 2010 was between 30-40 cents / kWh. For context, the all-in cost of coal or natural gas is in the range of 6-7 cents / kWh. So in 2010, the cost of solar energy was > 5x the cost of fossil fuel based electricity. Today, the cost of solar is ~2-5 cents / kWh with many bids for new utility scale projects coming in at less than 2 cents (e.g. 1.35 cents / kwh in Abu Dhabi and 1.5 cents / kwh in New Mexico).

This is a very, very big deal. In the span of just 10 years, we’ve seen the cost of solar go from a fringe, do-gooder energy source to radically cheaper than “conventional” electricity production. So much cheaper, in fact, that mainstream financial publications are projecting that building new solar will soon be cheaper than merely operating existing coal or natural gas plants. Wow! That feels crazy to type.

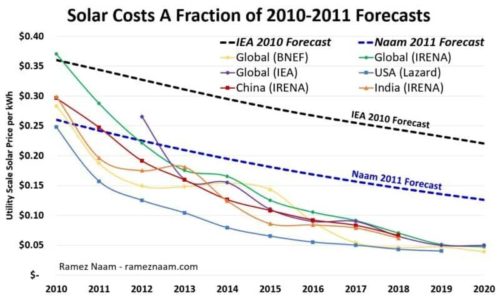

While I agree with much of Thiel’s criticism of the industry in his cleantech post mortem above, what he and so many others got wrong is the idea that there were no radical secrets or breakthroughs happening in what seemed to be an incremental energy world. The secret is that solar is an exponential technology that follows Wright’s Law. Basically, every doubling in cumulative capacity has historically led to a 30-40% drop in the cost of solar energy. I’ve seen only 3 investors/commentators consistently call this over the last several years: Ramez Naam, Tony Seba, and Cathie Wood/Ark Invest. And even they underestimated just how much the price would fall! Take a look at this solar cost chart from Ramez to see the International Energy Agency’s projections vs. his own vs. what actually happened.

His forecast was the most aggressive to date – and even he overestimated the 2020 cost by >2x.

2) Storage and EVs are falling down similar cost curves

Now you’re probably thinking: great – solar is ridiculously cheap, but it still doesn’t solve our societal energy needs for one major reason: intermittency. The sun only shines during the day. And on some cloudy days, not even then. And the demand on the grid is notoriously prone to spikes where the cost of energy can jump an order of magnitude for 1-2 hours when everyone is cranking up their A/C together. That’s where natural gas peaker plants make their living. Sure they’re more expensive and much dirtier than solar, but they’re reliable and can be turned on/off exactly when needed. Solar simply can’t compete with that kind of reliability.

That’s all true. But this is where things get really exciting. Solar cannot solve the intermittency problem by itself. But a complementary technology is almost ready to do the job: batteries. Storage has always been the holy grail of the energy industry. Once you can cheaply store electricity then you are free to overproduce during the sunny parts of the day to safely use a fraction of the excess at night or during peak hours.

Lithium-ion batteries are following along a very similar cost curve to solar. The slope is not quite as steep – every doubling in cumulative capacity produced yields around 20-30% cost reductions – and it’s a few doublings behind solar. But I believe that within the next few years, the cost of solar + storage will beat the cost of natural gas peaker plants. Research from Ark Invest suggests we’re already there for peaker plants used only 10% of the time (the average usage amount for such a peaker). And we should be there in < 5 years (maybe much sooner) for plants used < 25% of the time. Unlike these antiquated plants, the price of solar and storage will only continue to drop from there via a virtuous cost reduction/deployment cycle.

And this is just to speak of conventional Li batteries. Other alternative storage technologies like flow state or compressed air storage batteries are themselves showing promise (though they’re much earlier in the pipeline). Other “virtual batteries” which offload excess energy for productive purposes like running data centers or mining bitcoin are also extremely effective here. I’ll explore the concept of Bitcoin Virtual Batteries more in my next post.

BTW, given that the cost of batteries is the primary driver for Electric Vehicle cost (20-30%), it should come as no surprise that EVs are following along a similar cost curve.

One last note: virtual and real batteries will solve most of society’s daily intermittency problems, but there’s still the issues of seasonal intermittency and some mission critical energy needs for which even a < 1% chance of downtime is unacceptable (e.g. hospitals). For these cases, larger, more interconnected grids and some base load supply from hydro, nat gas, or possibly next gen nuclear will almost certainly play a role. But that’s a conversation for another article.

3) Innovation in Financial Engineering

Even with the radical collapse in price of solar and storage, the upfront cost for these assets is still in the thousands of dollars for homeowners and 10s to 100s of millions of dollars for utility scale installations. These are still very expensive projects for anyone to undertake on their own balance sheet. Fortunately, we’ve seen a tremendous amount of innovation around financial engineering and deployment models. The biggest breakthroughs were the Power Purchase Agreements from SunEdison and solar leases from SunRun, which pioneered $0 solar for businesses and homeowners respectively. The ability to have a third party finance a solar project and guarantee a fixed energy cost or amount of savings was a major development that helped bring about current market conditions.

We used a very similar model at my last startup, Bright, which is now the leading residential solar company in Mexico. Other companies like Mosaic helped to pioneer solar loans. Jigar Shah, the former CEO of SunEdison, is bringing this innovative financial model again to other climate tech like batteries, EV charging infrastructure, energy efficiency, etc. at billion dollar scale through his new fund, Generate Capital. Companies like kWh Analytics built insurance products that helped large pools of capital become comfortable investing in the space.

4) Smart grids and smart homes

The other major breakthrough in this industry is data accessibility. Most grids around the world are remarkably complex and impressive machines (check out this great read for context), but were ultimately opaque to the end user. Until now. The U.S. is on pace to deploy >100 million smart meters by the end of the year. The rest of the world is doing the same. Much of this data is publicly available via open standards. Meanwhile, the falling cost of sensors and rapid deployment of smart thermostats and Alexas leads me to believe that the promise of the smart home is finally coming to fruition. Smart devices and buildings that can turn/off only when they’re actually needed can go along towards improving energy efficiency, which while not as sexy as renewable energy/storage, is a huge piece of the ultimate energy puzzle. By some estimates, the U.S. wastes >60% of the energy we create. And, anecdotally, my experience is that this is much worse in emerging markets.

Where to Invest?

So given all of the above reasons to be excited, the next question is: where should investors participate in the clean energy revolution? For institutions (and increasingly individuals), I think there’s a lot of good reason to focus on deployment capital: i.e. unsexy project finance with long-term reliable returns. As a venture investor, though, I still believe that there is a ton of greenfield opportunity left. Here are some of the areas that I’m excited about:

As you can see, the field of possibilities for the future of venture backable clean energy startups is enormous! The rapidly declining costs for solar + storage, innovations in financial engineering, and proliferation of smart devices/data collection brings us to what feels like should be the steepest portion of the clean energy adoption S curve. If you’re building one of the companies I mention, or even better, one that I haven’t considered yet – please reach out 🙂

Thanks to Alvaro Migoya, Jason Laster, Nat Bullard, Tommy Leep, Alex Pruden, David Gabeau, Pablo Castellanos, Arturo Duhart, and Ali Chehrehsaz for the conversations and feedback.

News

Happy New Year! The final quarter of 2025 brought meaningful momentum across the V1 portfolio, with founders closing Q4 strong and building toward an even bigger 2026. We’re excited to carry that progress into the months ahead. Before we fully shift our focus to what’s next, here’s a look back at a few highlights and […]

Yet another year has flown by. This past quarter was a busy one, which should…

The V1 family kicked off the new year with fresh energy and no shortage of…