Cryptocurrencies have strong network effects, built around the concept of mining. The more miners participate,…

Crypto / Blockchain

The original thesis for cryptocurrencies was that it would be a winner-takes-all game due to the strong network effects around mining. And Bitcoin’s first few years seemed to prove this thesis true. Its share of the total market cap for cryptocurrencies was as high as 90% and was still holding at 80% at the beginning […]

Cryptocurrencies have strong network effects, built around the concept of mining. The more miners participate,…

Every new technology platform has been built around a specific new capability. The Internet connected…

The original thesis for cryptocurrencies was that it would be a winner-takes-all game due to the strong network effects around mining. And Bitcoin’s first few years seemed to prove this thesis true. Its share of the total market cap for cryptocurrencies was as high as 90% and was still holding at 80% at the beginning of 2017.

The original thesis for cryptocurrencies was that it would be a winner-takes-all game due to the strong network effects around mining. And Bitcoin’s first few years seemed to prove this thesis true. Its share of the total market cap for cryptocurrencies was as high as 90% and was still holding at 80% at the beginning of 2017.

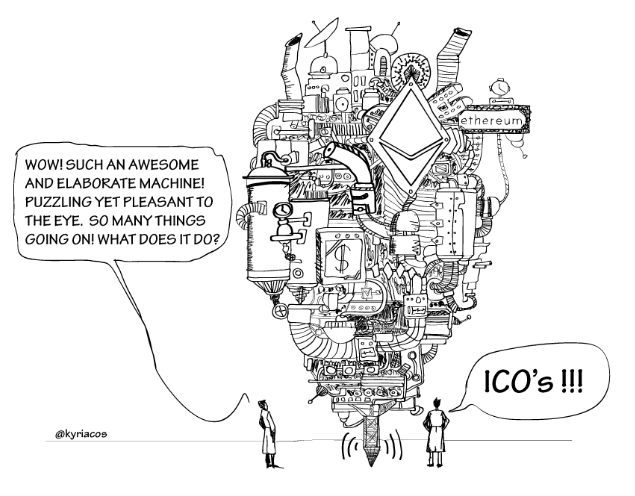

However, Ethereum has gained so much value since the beginning of the year that it’s looking quite possible that it could soon replace bitcoin as the largest and best capitalized blockchain out there.

Will Ethereum end up being the winner and lock up the market? It’s too early to tell, but I think there’s a good chance we will end up with a few blockchains that each have their own strengths and attributes, including these four elements: scalability, safety, decentralization, anonymity.

Scalability

We need a solution that can run an increasing amount of transactions through the blockchains while keeping confirmation time and costs per transaction low. Ethereum has a clear advantage over Bitcoin in this respect. As usage of Bitcoin has recently increased, so have confirmation times and costs.

Security

Security is often a trade-off to scalability. The more secure a blockchain, the longer the transaction confirmation times and the higher the costs. Bitcoin is recognized as having an advantage over Ethereum in this respect.

Decentralization

How decentralized is a blockchain and what’s the likelihood that certain stakeholders can take over the majority? With Bitcoin, there’s the risk (even if it’s just a hypothetical one) that if a single entity can contribute to the majority of network’s mining hashrate, they could have full control of the network and manipulate the public ledger (the 51% attack).

Anonymity

How anonymous are the participants on a blockchain? This is the use case that Zcash is built around: Zcash payments are published on a public blockchain, but the sender, recipient, and transaction amount may remain private.

It will be interesting to watch how all of this will play out over time. Which elements will turn out to be more important than others for determining the success of blockchains? How will different blockchains work together to complement each other’s strengths and weaknesses? Will some blockchains copy the most successful elements of others (e.g. Ethereum copying zero knowledge proofs from Zcash). And, what new elements will emerge over time? We are eagerly watching.

Thanks to Dan Romero from Coinbase and Ben Roberts from Citizen Hex for reviewing earlier drafts of this post.

Portfolio

It’s been an eventful quarter (when has it not?), and somehow we’ve already crossed the halfway mark of 2025. We wanted to take a moment to highlight just a few of the wins, milestones, and momentum we’ve seen this past quarter. As always, there’s a whole lot happening behind the scenes that can’t be shared […]

The V1 family kicked off the new year with fresh energy and no shortage of…

At the end of Q1, we anticipated that a tech sector slowdown is ideal for…