While the past 10 years have seen a big focus on marketplaces for physical goods…

Entrepreneurship, Marketplaces / Social / Collaboration / Network Effects

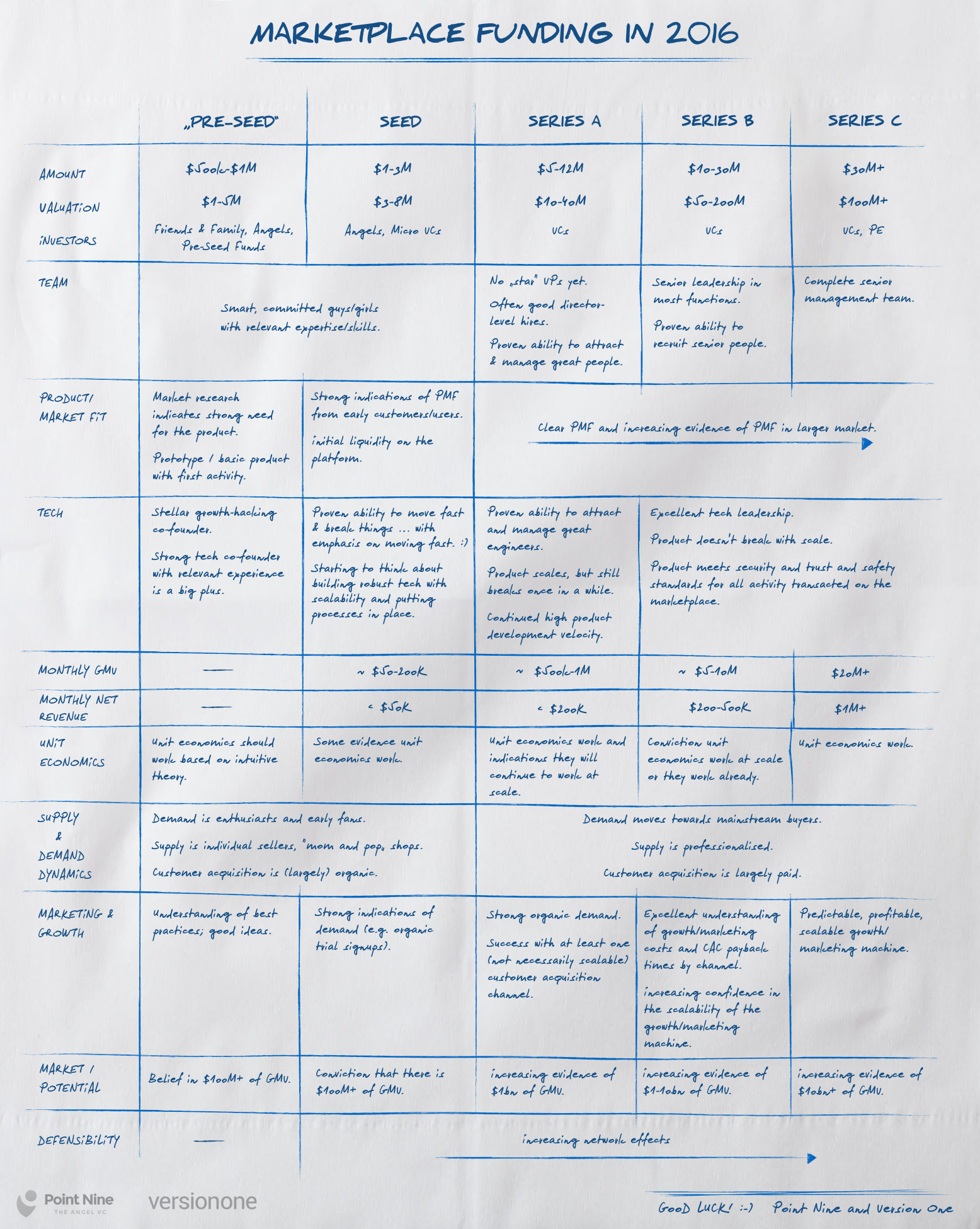

A question we’re often asked during conversations with early-stage entrepreneurs is “What do investors look for when considering a Seed or Series A startup?” At some point, this question might be followed by “What does it take to get to Series B?” The expected trajectory takes a startup from Seed to Series A, Series A […]

While the past 10 years have seen a big focus on marketplaces for physical goods…

A big part of Silicon Valley's success as a startup ecosystem can be linked to…

A question we’re often asked during conversations with early-stage entrepreneurs is “What do investors look for when considering a Seed or Series A startup?” At some point, this question might be followed by “What does it take to get to Series B?”

The expected trajectory takes a startup from Seed to Series A, Series A to Series B, and so on. But as our good friend Christoph Janz at Point Nine Capital points out, “financing rounds are obviously not a goal in itself. They are a means to a bigger goal.”

Two months ago, Point Nine put together a very helpful chart linking important milestones and fundraising stages for SaaS companies: “What does it take to raise capital, in SaaS, in 2016?”

We recently collaborated with them to create a similar framework for marketplace startups which you can access here as a Google Sheet or in stylized Marketplace Napkin form 🙂

Investing is part science and part art – as such, there will be exceptions to every rule here. Some startups can raise a big round early on (for example, when the founding team already has large exits under their belts), while other startups feel the frustration of struggling to raise money when they’re hitting every milestone on the chart.

Yet while it’s generalized, this chart can be a useful framework for founders to understand what benchmarks we as marketplace investors look for, and when we look for them.

Portfolio

It’s been an eventful quarter (when has it not?), and somehow we’ve already crossed the halfway mark of 2025. We wanted to take a moment to highlight just a few of the wins, milestones, and momentum we’ve seen this past quarter. As always, there’s a whole lot happening behind the scenes that can’t be shared […]

The V1 family kicked off the new year with fresh energy and no shortage of…

At the end of Q1, we anticipated that a tech sector slowdown is ideal for…