Few launches have been as timely. Over the past month, those of us on the…

Crypto / Blockchain, Portfolio, Version One

We are excited to announce our investment in Dinari’s $7.5m seed round, alongside Third Kind Venture Capital, SPEILLLP, Sancus Ventures, 500 Global, and Balaji Srinivasan. The tokenization of real-world assets (RWA) is one of the most interesting use cases for the blockchain, gaining momentum inside both crypto and traditional finance communities. We have seen start-ups […]

Few launches have been as timely. Over the past month, those of us on the…

We are very happy to announce our seed investment into Defined, a programmable data platform…

We are excited to announce our investment in Dinari’s $7.5m seed round, alongside Third Kind Venture Capital, SPEILLLP, Sancus Ventures, 500 Global, and Balaji Srinivasan.

The tokenization of real-world assets (RWA) is one of the most interesting use cases for the blockchain, gaining momentum inside both crypto and traditional finance communities. We have seen start-ups going after all sorts of categories, from real estate to mutual funds to art. Having an on-chain record of asset ownership has a number of advantages: it allows 24/7 trading and fractional ownership structures and reduces barriers to entry which all lead to increased liquidity.

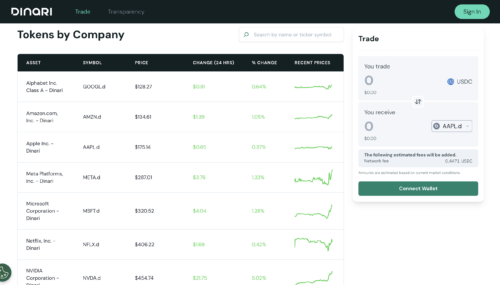

Enter Dinari, the start-up that wants to provide blockchain-backed access to corporate equity. Alongside its seed raise, the company announced the launch of its dShare platform outside of the US. dShares (Dinari Securities Backed Tokens) offer access to securities such as Apple, Google, and Tesla stock. The platform provides transparent blockchain transactions, immutable proof of ownership, the ability to transact with your crypto wallet, composability with other blockchain products, and instant settlement.

By tokenizing publicly traded corporate equity securities, the dShare Platform can enable users outside the US to gain exposure to publicly traded corporate equity securities in a trusted and safe manner. This is significant as a large number of people in countries like Mexico and Thailand own a blockchain wallet, but no brokerage account. Bloomberg has more detail on how the product works and on the regulatory efforts the team has undertaken to be compliant.

Dinari was founded in 2021 by the talented team of Gabe Otte, Jake Timothy and Chas Rampenthal. Gabe was the former founder of Freenome before he switched his attention from bio to crypto.

There are literally trillions of real world assets waiting to be tokenized on the blockchain and we are excited to see Dinari lead the way in the corporate equity category. You can learn more about the company here or by following them on X.

News

Happy New Year! The final quarter of 2025 brought meaningful momentum across the V1 portfolio, with founders closing Q4 strong and building toward an even bigger 2026. We’re excited to carry that progress into the months ahead. Before we fully shift our focus to what’s next, here’s a look back at a few highlights and […]

Yet another year has flown by. This past quarter was a busy one, which should…

The V1 family kicked off the new year with fresh energy and no shortage of…