As the year comes to an end, it’s a natural time to pause and reflect…

Version One

2020…the year of the pandemic. We’ve seen a tremendous amount of human loss and hardship, but it’s also been a year full of hope and innovation. Technology’s role in the human response to Covid-19 cannot be understated. Hundreds of millions of people suddenly started working from home and attending school/university from home. We shifted a […]

As the year comes to an end, it’s a natural time to pause and reflect…

2021 might be remembered as the year the world started to fully embrace the opportunity…

2020…the year of the pandemic. We’ve seen a tremendous amount of human loss and hardship, but it’s also been a year full of hope and innovation.

Technology’s role in the human response to Covid-19 cannot be understated. Hundreds of millions of people suddenly started working from home and attending school/university from home. We shifted a large portion of our lives from offline to online, not missing a beat, thanks to the power of technology. That would never have been possible even five years ago!

And there’s also the record-breaking speed with which scientists were able to develop incredibly successful vaccines for Covid-19. Normally, new vaccines take years, if not decades to develop. We’re on track to have tens of millions of people inoculated by the end of the year, with a lot of optimism about the future of mRNA vaccines. That’s another huge win for technology and science.

Our portfolio and investment activity this year reflects the importance of technology and “digitization of everything” spurred on by Covid-19. We had one of our busiest years ever with eleven new investments across our core (SaaS and marketplaces) and emerging areas (crypto, energy/climate, and healthcare). We shifted to Zoom meetings with founders and deals came together without a single in-person meeting. And existing portfolio companies raised the most money in the history of our fund, with over $300m in follow-on funding rounds.

Enterprise SaaS and marketplaces continue to be very established and favored categories for founders and investors alike. But two of our emerging areas of focus had their moments in 2020:

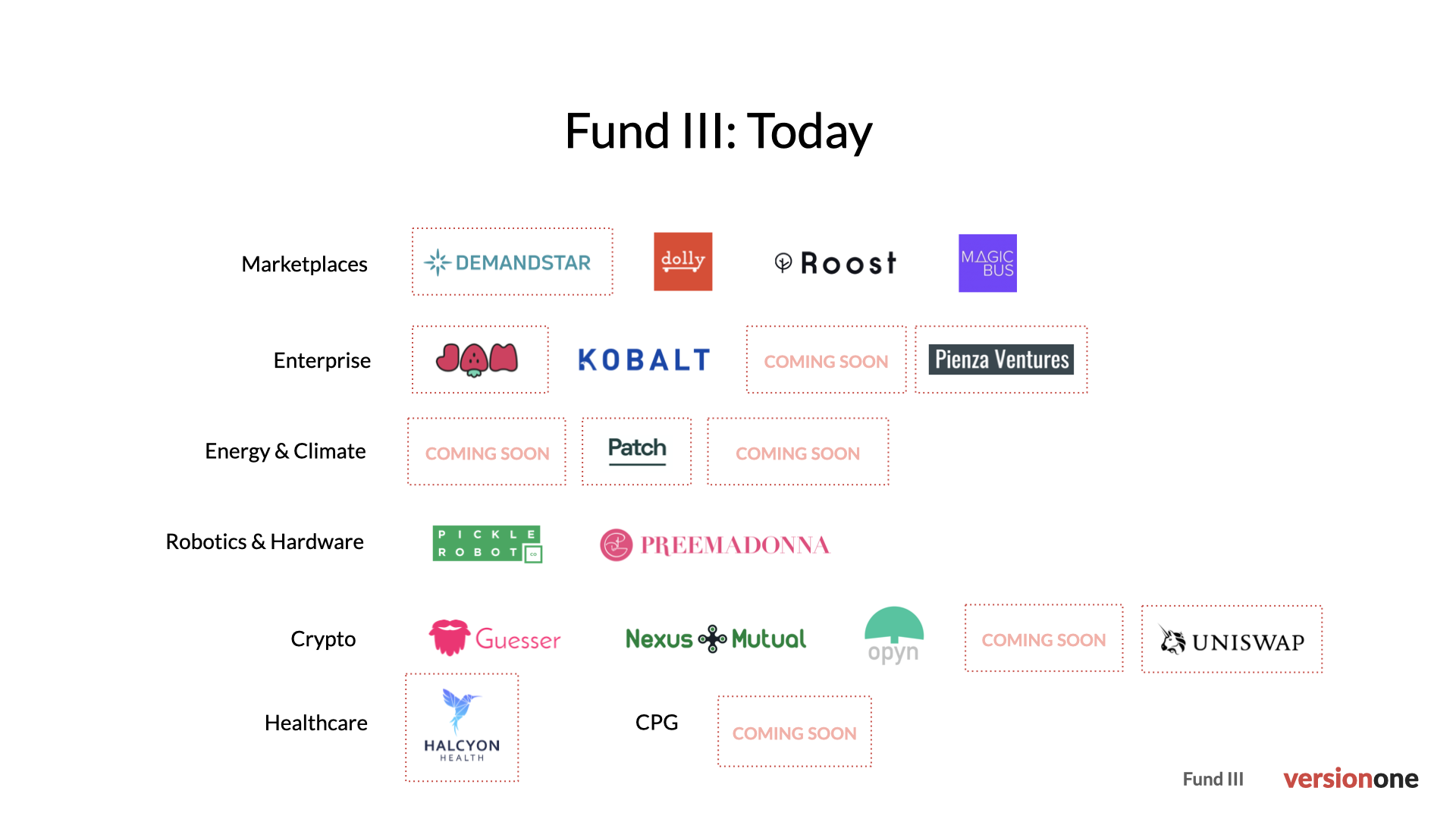

Here’s what our Fund III looks like today (boxes mark new 2020 investments):

Last but not least, Version One continues to evolve. We refined our investment thesis to focus on mission-driven founders. We raised our first opportunity fund to double down on our break-out companies. We added Max to the team (who is especially active in crypto and energy). And we continue to share what we have learned as (former) operators and investors with the broader community. We published the now already 3rd (!) edition of our guide to marketplaces. And looking at our anti-portfolio keeps us humble every single day 🙂

Huge thanks to our portfolio founders for continuing to push hard to invent the future and create technology that makes a difference. Thanks for having us on your journey!

Happy holidays to everyone!

-Boris, Angela & Max

Version One

After more than 13 years of building Version One, 2025 was easily one of our wildest years—in the best possible way. We made nine new investments (our most in one year ever), spanning six different categories. We also distributed over $25M back to LPs across Funds II and III. And on top of all that, […]

2021 might be remembered as the year the world started to fully embrace the opportunity…

2020…the year of the pandemic. We’ve seen a tremendous amount of human loss and hardship,…