Six months ago, we published A Guide to Marketplaces. Marketplace companies comprise an important part…

e-Books, Favorites, Marketplaces / Social / Collaboration / Network Effects

Note: We’ve updated this handbook — read the latest and greatest 3rd edition here! About two years ago, we put together The Guide to Marketplaces. It compiled many of the insights we’ve learned from working with great marketplace companies and analyzing the industry. One third of Version One portfolio companies are marketplace companies, and with […]

Six months ago, we published A Guide to Marketplaces. Marketplace companies comprise an important part…

We’re thrilled to announce the third edition of “A Guide to Marketplaces.” We published our…

Note: We’ve updated this handbook — read the latest and greatest 3rd edition here!

About two years ago, we put together The Guide to Marketplaces. It compiled many of the insights we’ve learned from working with great marketplace companies and analyzing the industry. One third of Version One portfolio companies are marketplace companies, and with each company, we’re learning more about marketplace success strategies and how to overcome the challenges associated with liquidity and scaling.

Two years is a long time in the tech world. And much has changed since we first published the guide. Millions of dollars have poured into blockchain projects and cryptocurrencies. We have also seen marketplaces evolve from products, to services, to information. As such, we realized it was time to refresh the guide and we’re pleased to announce the availability of The Guide to Marketplaces, Second Edition. You can download the PDF or ePub version.

We truly appreciated everyone’s feedback on the first edition, and we hope you find the second edition as useful as the first. Major additions include an entirely revised section on decentralized marketplaces, a new chapter on marketplace exits, and a Funding Napkin that links milestones with fundraising stages for marketplace companies.

We’d love to hear if you find this content useful. What should we expand on in the next edition? Did we leave anything out? Please leave a comment below or reach out to us directly.

Happy reading,

Angela and Boris

Table of Contents

The web changes everything. In just 25 years, the Internet has become so ubiquitous that it’s hard to remember how things were done before.

Nowhere is this more true than with how goods and services are exchanged. Not too long ago, the marketplace was a purely local affair. Artisans and farmers brought their goods to the local marketplace to be sold. But when the marketplace moved online, it shattered the very notion of local and global. You’re now able to buy anything and everything with just a few clicks, and vendors have unprecedented access to a global audience.

Let’s take books as an example. Used and rare books were once limited to tiny backstreet sellers. If they were lucky, book-lovers might happen upon a prized out-of-print edition while browsing the aisles. Moving the process online brought about a radical shift. You just need to type in an author’s name and title, and scores of choices will pop up from booksellers all over the world. If there’s a book out there, it can be found. You can buy a hard-to-find copy of a used hardback from someone in San Francisco, read it, then sell it to someone else living in Dublin.

Boris Wertz saw this transition first hand. Back in Germany in 1999, he launched an online marketplace for books, JustBooks. In 2002, JustBooks was acquired by AbeBooks and by 2008, AbeBooks was doing several hundred million dollars a year in transactions between buyers looking for rare prints, limited runs, and used textbooks and the sellers who had them. AbeBooks was subsequently acquired by Amazon in 2008.

The online marketplace is a true example of a green-field opportunity. Whether it’s rare books or home repair services, an online marketplace brings buyers and sellers together in ways that were never possible before. It creates new buying and selling opportunities. And, unlike an e-commerce site, anyone can build a marketplace with minimal capital requirements since there’s no inventory to buy, build, or manage.

As a result, the marketplace business model has attracted countless entrepreneurs. When a marketplace works, it works really well. There’s high potential for long-term profits at scale. And once a marketplace achieves liquidity, it’s hard for others to compete. That’s why you probably can name only one online auction site.

But, as many entrepreneurs find out, it’s hard to get the virtuous cycle of supply and demand to reach liquidity. You need to ramp up both sides in near unison. If there are buyers but few sellers, the buyers leave. Yet if there are no buyers, how do you convince the sellers to sign on?

After AbeBooks was acquired by Amazon, Boris moved into investing, first as an angel and now with Version One Ventures, with Angela Tran Kingyens joining in 2013. Over the past decade, Version One has invested in great marketplace companies, such as Drover, Dwellable, Headout, Indiegogo, Kinnek, Shippo, Top Hat and VarageSale. We have learned from and helped many passionate entrepreneurs looking to break down the walls for how goods are bought and sold in their particular space.

What follows here are some of the insights we’ve learned while observing, funding, and building marketplaces for more than two decades. There’s no single way to build and scale a marketplace, but we hope this handbook provides some insight to help you in your journey. Now let’s get to work.

— Boris and Angela,

March 1, 2018

An online marketplace is a type of e-commerce site that connects those looking to provide a product or service (sellers) with those looking to buy that product or service (buyers). These buyers and sellers may have had trouble finding each other before, and thus the marketplace creates efficiency in an otherwise inefficient market.

eBay’s launch in 1995 sparked the first wave of product-focused marketplaces, and Uber’s success in 2010 brought a second wave of marketplaces for services, and combinations of product and service marketplaces (such as food delivery). And today, we’re approaching a third wave of information marketplaces fueled by blockchain technology.

With the explosion of marketplaces, there are now sites to connect bands with music venues, homeowners with snow plowing services, and students with used textbooks.

While these marketplaces spread across diverse market segments, there are two common elements to every online marketplace.

1. Marketplaces aggregate many sellers and their inventory

What sets a marketplace apart from a standard e-commerce site is that the goods and services are supplied by a third party. In most cases, the marketplace platform acts as a type of digital middleman.

The independence of suppliers is an increasingly grey area when it comes to service marketplaces. Most on-demand service marketplaces like Uber, Handy, and Postmates stress the independence of their workforce, while other startups like Munchery in San Francisco and MyClean in New York switched to full-time employees, in order to gain more control over the customer experience.

2. Marketplaces include a transaction element

A marketplace differs from a listing site by taking care of at least part of the transaction between buyer and seller. A true marketplace like eBay and Uber manages the entire transaction, from listing to payment processing (with the service and goods delivered offline).

For the purpose of this handbook, we’re also including those marketplaces where transactions are initiated but not processed on the platform — for example, lead generation sites like Thumbtack where providers send quotes through the platform. By contrast, a review site like Yelp is not a marketplace, since there’s generally no transactional element involved.

A marketplace can be categorized in terms of its participants (on both the supply and demand side):

We’ll discuss marketplace metrics in detail in Chapter 5, but the two key metrics for any marketplace startup to understand are:

1. GMV (Gross Merchandise Value):

GMV is simply the total dollar value of everything sold through the marketplace in a given time period. This is a different and much bigger number than the platform’s revenue. Net merchandise value is GMV minus the value of returns (products) or cancellations (services).

2. Take Rate:

Take rate is the percentage of transaction value that the marketplace collects in fees. Setting the take rate is typically the cornerstone of a marketplace’s monetization and business model.

Bill Gurley of Benchmark Capital wrote the definitive post on which markets are the best fit for marketplaces: “All Markets Are Not Created Equal: 10 Factors To Consider When Evaluating Digital Marketplaces.”

While Bill laid out ten factors, we believe six to be the most essential:

1. High fragmentation

It’s much easier to start a marketplace when there are a lot of suppliers and buyers. When there are just a few suppliers, they’ll likely fight the arrival of a new intermediary in their market and won’t want to share in the economics (meaning a low take rate for your marketplace). In addition, a marketplace can create the most value in a highly fragmented market, since there’s a true need to help buyers and sellers find one another.

2. The buyer/seller relationship: monogamy vs. playing the field

In those markets where buyers are fiercely loyal and use the same supplier every time, the value of a marketplace is reduced. For example, once consumers find a doctor or cleaning service they like and trust, it’s easier to stick with the known provider rather than take a chance on, or spend time searching for, someone new.

Once consumers are comfortable with a certain provider, there’s little need to visit or use the marketplace again. The same is also true for commoditized products where you source products from the same supplier (e.g. diapers on the consumer side and raw materials for businesses).

3. Higher frequency

Bill Gurley said, “All things being equal, a higher frequency is obviously better. GrubHub, OpenTable, 1stdibs (for the designer) and Uber are all high frequency use cases, where consumers can rely on the marketplace as a utility. Many failed marketplaces attack purchasing cycles that are simply way too infrequent, which makes it much more difficult to build brand awareness and word-of-mouth customer growth.”

When evaluating frequency, it’s important to differentiate between how often a buyer uses a service and how often they use the marketplace. For example, you might need a babysitter every day, but you only look for a new babysitter every two years (back to point #2).

4. Total Available Market (TAM)

As with any new business opportunity, a proper TAM analysis is imperative: how big is the total available market and how much can you capture? Keep in mind that the best online marketplaces create new value; therefore, the current market size does not necessarily paint an accurate picture of the opportunity.

For example, Uber’s convenience has greatly expanded the car service market to more users and geographic locations. Gurley gives an excellent analysis on Uber’s impact on the overall market size of the car-for-hire transportation market.

5. Transactional: being part of the payment flow

When buyers and sellers need the marketplace to exchange money, the potential take rate is much higher than when transactions happen offline. Think about it this way: When a marketplace handles the transaction, it pays the supplier their portion of the revenue with the fees automatically deducted, instead of having to send them a bill at a later date. This makes fees much more palatable to most sellers.

6. The ability to expand the overall market and create value

Virtually all marketplaces create efficiency: they make it easier for buyers and sellers to find each other and complete a transaction. But, not all marketplaces create value equally. For example, marketplaces may connect schools with substitute teachers, visiting doctors with hospitals, commercial landlords with retailers interested in setting up pop-up shops.

These all certainly increase efficiency, but they might not necessarily expand the market. The likely reason is because there’s finite supply and finite demand. In other words, a new marketplace won’t create a new crop of teacher or doctors, or school and hospitals. And in the absence of a new online marketplace, both sides would probably find each other eventually, albeit in a less efficient way.

The best marketplaces can tap into new groups of participants and grow the overall number of transactions. The sharing economy is a great example of creating value. People who never thought they’d be landlords or hotel proprietors are now hosts on Airbnb. And, people who never thought they’d transport people for money are now drivers on Uber. These platforms empower whole new groups of people to become sellers. More sellers = more participation on the platform = more liquidity = more transactions = more overall value.

You don’t need to hit all six criteria (or all ten on Bill’s list) to build a good marketplace. But the better you score, the higher the overall potential of the marketplace. And underlying all these six factors we consider the magnitude of potential value creation.

The narrative of the little guy going up against the giant is baked into the culture of Silicon Valley. There’s always an incumbent marketplace (even if it’s Craisglist), so finding the right business model to break into an existing market is critical for any new marketplace.

Any newcomer should focus on the incumbent’s most important weakness and that weakness will be different for each situation. Some of the common strategies are:

1. Lower the take rate

According to Albert Wenger of Union Square Ventures:

“I don’t see take rates of 20% or more as sustainable in the long run. Why? Because they (a) impose too heavy a tax on marketplace activity and (b) produce too much profitability for the marketplace operator. The first is bad from the perspective of efficiency as it will crowd out some transactions that would benefit from taking place in the market. The second will provide the incentive for competing marketplaces to be created.”

For example, Craigslist offered free listings to compete with the paid listings in the traditional classified sections of newspapers. Applying Clayton Christensen’s theory of the Innovator’s Dilemma, most incumbents find it hard to follow down the market. They brush off an upstart as being too small or too low end to matter. By the time the incumbent finally gets around to addressing the new innovator, the upstart has already found traction.

However, unseating an incumbent based on lower take rate alone is difficult, since the network effects of the existing marketplace will make it hard for a newcomer to build any momentum. You’ll typically need to differentiate in other ways in addition to lowering the take rate.

2. Go vertical

A startup can unbundle a generalized marketplace and focus on creating the best product for a specific vertical. Many marketplaces have struck gold by picking one thing and doing it extremely well. For example: StubHub vs. Craigslist and HotelTonight vs. Expedia.

This is a strategy that has been spectacularly effective for many verticals and the market map that venture capitalist Andrew Parker’s created back in 2010 has become the blueprint for tracking the different companies that have chosen to carve out niches from Craigslist. David Haber offered an updated chart at the end of 2012 to demonstrate just how effective the vertical strategy can be.

In some cases, marketplace businesses build traction in smaller verticals before expanding their reach. Geographical marketplaces often nail one location before expanding into new territories.

Indiegogo first went after the indie film market before opening up to other categories. Expanding outward from the niche often happens organically as sellers start listing items in new categories. For example, Etsy sellers began listing craft supplies and tools and this category has become one of Etsy’s largest today.

Keep in mind that category expansion doesn’t always work as planned. When Boris was COO at AbeBooks, he thought they could expand the site into new books. Despite a strong selection at competitive prices, the new books category never lived up to expectations and most of the buyers stayed with their existing retailers (mainly Amazon).

3. Develop a 10x better product

Another strategy is to build a product that’s ten times better than the incumbent’s. This has been the key to VarageSale’s success (one of our portfolio companies that has done a great job building mobile-first, social, and safe local marketplaces) vs. Craigslist. Or Uber’s success

against the taxi industry. Or think about how Airbnb’s fortune changed when they started using professional photography.

Keep in mind that sometimes a 10x better product itself isn’t enough. Benchmark’s Sarah Tavel wrote that multi-billion dollar businesses build a 10x better product while also recasting incumbent cost structures. In other words, a better product might not be enough if only the very wealthy will be willing or able to afford the service or convenience. She wrote that “a 10x product and save people money” is the undercurrent running through dozens of breakout companies, including Uber, Airbnb, and WhatsApp.

Lastly, these kinds of opportunities are rare and hard to pull off, because the incumbent’s network effects often outweigh any product improvements.

Source: The Gong Show, Andrew Parker, 2010

Source: David Haber, TechCrunch, 2012

4. Unique inventory

Last but not least, a marketplace startup can focus on the supply side, and identify opportunities to bring unique inventory to underserved markets. This strategy certainly helped Airbnb against HomeAway, as well as Etsy vs. eBay.

In some cases, you can even create supply that didn’t exist before. Prior to Airbnb’s success, there wasn’t much incentive for people to post their unused space. Not many people would be comfortable advertising a room in their apartment on Craigslist. Now, Airbnb is a primary source of income, or at least a major supplemental source of income, for a lot of folks.

One of the main reasons why investors and entrepreneurs love marketplaces is the power of their network effects and how it creates a high degree of defensibility for startups. Keep in mind that “network effects” means more than just a large number of users — network effects kick in when the value of a product depends on how many other users there are.

When a new user/member is added to the network, it increases the value of the product or service to all other users. This increased value can come in the form of cost reduction (in user acquisition as an example), higher liquidity (in a marketplace), stronger community or deeper relationships (in social networks), etc.

Generally speaking, network effects are categorized into two types: direct and indirect.

Direct Network Effects

The simplest network effects are direct: an increase in usage leads to a direct increase in value for all other users. Social sites like Facebook, Twitter, and Wattpad have a direct network effect. If you join Facebook and start sharing content I’m interested in, Facebook becomes more valuable to me

When we think about direct network effects, we consider the roles of the participants. In a marketplace, users are buyers, sellers, or sometimes both. Likewise, in a community or social platform, users can be content creators, content consumers, or both.

In a marketplace, the roles of a buyer and seller are typically distinct — effectively creating two-sided network effects. When there’s overlap between buyers and sellers, it’s easier to get your network off the ground at the beginning as you’ll achieve liquidity more quickly. For example, in Etsy, Craigslist, and Airbnb, we see some overlap between buyers and sellers (or hosts and guests in Airbnb’s case).

While overlap helps a marketplace at the beginning, two-sided network effects add to the defensibility of your marketplace over time (since there’s more fragmentation). For example, with Uber, there’s little overlap between drivers and riders.

We also need to consider how network effects fall on the local-global spectrum:

Indirect Network Effects

Network effects can also be indirect. In these cases, when more people use a product or network, it sparks the production of complementary products and goods — thus increasing the value of the original product. A common example is with hardware and software: the more people that use a hardware product, the more likely it is that developers will build software and apps for that hardware.

Indirect network effects can also apply to marketplaces. Developers often build applications and products on top of APIs of existing marketplaces and platforms. For example, Shopify has a very active developer/value-add app ecosystem. In addition, countless services sprout up to support popular platforms — like Airbnb management services (Guestly) and driver rental car options for Uber/Lyft (Drover).

How do network effects differ from virality?

When information can be shared rapidly and widely from one user to another, or when the rate of adoption increases with adoption, we have virality. In other words, the product grows faster as more users adopt it (to a certain limit).

Network effects and virality often go hand-in-hand, but not all network effect products are viral, and not all viral products have network effects. For instance:

As you build your marketplace, don’t fall into the trap of confusing network effects with virality.

Marketplaces have low virality, but network effects are critical to scaling and sustaining a marketplace. Think about how users benefit each time someone else participates, and in what way: directly or indirectly. Understanding how network effects impact your startup brings you one step closer to building a more defensible product.

In addition, we can’t underestimate the importance of data network effects to the success of a marketplace. Tophatter (a mobile e-commerce marketplace with no prior data infrastructure or data background) has been refining its marketplace by making decisions about what products go into the marketplace (e.g. seller-side analytics to determine which items and sellers are good). Their goal is to build a personalized marketplace for each buyer. They built the right data infrastructure to generate and evaluate personalized recommendations for users on the platform.

The result has been a 30% increase in clicks. The company is expecting to make $100 million in revenue in 2017 (compared with nearly $40 million in 2016). Much of this growth is due to how data-driven the company is, especially when it comes to recommendations.

The earliest days in a marketplace are a tricky time. There’s a chicken and egg problem when it comes to supply and demand: customers need supply, and suppliers need customers. But it’s nearly impossible to ramp up supply and demand in lock step.

We’ve found that in most cases it’s best to focus on building up the supply first. That’s because there’s more incentive for sellers to invest their time in the early days. There’s zero motivation for customers to stick around without any inventory.

So how do you go about seeding supply? Here are five common strategies:

1. Identify unique inventory

One of the best types of suppliers to target are those people who don’t already sell online. For example, Etsy went after the producers of hand-made goods. These designers and crafters found their unique goods buried within eBay’s massive inventory and typically resorted to selling their items locally at craft shows, farmers’ markets, etc. Etsy came along and brought these local experiences online.

The advantage of focusing on unique inventory is that it won’t take much effort to persuade providers to join once they’re made aware of your site. In addition, these types of sellers will typically bring along some of their own buyers – helping you ramp up your customer base at the same time.

2. Convince existing sellers to list on your platform

If your ideal suppliers already have an online outlet, you’ll need to be creative and exert more energy to convince them to join your young marketplace. Airbnb is a classic example.

Airbnb’s target customers and suppliers were using Craigslist to buy and sell lodging outside of the standard hotel experience. Airbnb offered a more personal and trustworthy experience than the free-for-all on Craigslist, but Craigslist had one thing Airbnb didn’t: a massive user base and inventory.

As detailed in a Growth Hackers case study, Airbnb found some interesting ways to leverage the existing supply on Craigslist, including emailing Craigslist listers and encouraging them to check out Airbnb. While one could argue this approach was pretty close to spam, it most likely enabled Airbnb to cheaply reach tens of thousands of their targeted suppliers each day.

3. Bring customers to a provider

With service marketplaces, one of the easiest ways to build early liquidity is to approach a provider with a customer opportunity already in hand. A ready-to-go, paying customer is always much more compelling than talk about future potential.

For example, some restaurant delivery startups started out by scraping the web for menus from local area restaurants. Then when a customer places an order on their site, the startup goes to the restaurant to get the order fulfilled.

There are two challenges with this approach. The first is that the provider’s information (e.g. restaurant menu) needs to be available and up-to-date. Then, there’s always a risk that the selected provider won’t convert and you’ll end up leaving your customer high and dry. Even if a different provider fulfills the order, you may not be delivering a perfect experience to

the customer.

4. Pay for inventory

During the early days at Boris’ startup JustBooks, their first growth hack was buying books to list so they didn’t have an empty site. When Uber launched in Seattle, they paid town car drivers to idle. This generated the supply, and once the customers and money started rolling in, they switched those drivers over to commission.

Buying inventory artificially creates supply, improving the way the marketplace works at the outset. It’s an easy way to get inventory in the early stage, but it’s not scalable as it obviously gets expensive to both buy and manage inventory yourself.

5. Aggregate readily accessible inventory

The last strategy is to aggregate inventory that’s already listed somewhere, for example through affiliate programs. This approach will provide the initial scale that you’re looking for, but there are several key drawbacks. First, while you may have a lot of inventory, none of it will be unique: why should buyers come to your site instead of the other sites you’re pulling inventory from?

The second problem is that when you aggregate existing inventory, you run the risk of becoming a cross-platform utility rather than your own marketplace with lots of highly engaged users. Fred Wilson discusses this issue with regard to networks, but his words are equally relevant to marketplaces:

“If the initial utility of an app is to connect to a bunch of networks, collect information, present it, and then let the user engage with one or more of those networks, what incentive is there for the user to engage directly with other users of the app and help build a network inside of it?”

With that said, aggregating existing inventory can be an effective way to kick-start your marketplace early on. That’s what our portfolio company Dwellable did before quickly transitioning to their own inventory.

No matter which approach you use, it’s easier to build a strong community if there’s a large overlap between buyers and sellers. For example, think about the number of Airbnb hosts who stay with other hosts during their own travels. Likewise, sellers on Etsy also make purchases since they appreciate handcrafted goods. Peer-to-peer marketplaces are more likely to have sellers that double as customers and vice-versa.

The bottom line is this: if you are building a marketplace, you need to devise an effective strategy for ramping up supply. The next stage is getting to that virtuous cycle of supply and demand.

The virtuous cycle is the holy grail for online marketplaces. In this positive feedback loop, a high number of quality suppliers attract more customers; then more customers attract more suppliers to join. This cycle continues as a self-sustaining growth engine until both supply and demand reach critical mass to be “winner takes all.”

But how does a marketplace create the momentum for a virtuous cycle in the first place?

Identify and double down on the hot spots

One of the most important things you can do is identify and double down on the things that work in your marketplace. As you start scaling, there will be many matches and transactions between buyers and sellers. But not all matches are created equal. Identify where things are clicking on both the supply and demand side. This could be in certain geographies, audience segments, price points, and user behavior.

Then you’ll want to double down on these hot spots, often following Paul Graham’s advice to do things that don’t scale. Don’t worry that the absolute numbers hardly seem worth the effort. At this point you’re just trying to get the virtuous cycle going. If the market exists, you can recruit your suppliers and customers manually, then switch over to less manual (more scalable) methods.

“At some point, there was a very noticeable change in how Stripe felt. It tipped from being this boulder we had to push to being a train car that in fact had its own momentum.” Patrick Collison, Stripe

Airbnb is a classic example. Founders Brian Chesky, Nathan Blecharczyk, and Joe Gebbia frequently traveled to NYC to acquire their early users. Then when they realized that high quality listing photos were key to attracting customers (and differentiating the experience from Craigslist), they rented a $5,000 camera and went door to door, taking professional pictures of as many New York listings as possible. This approach led to two to three times as many bookings on their New York listings.

“When New York took off, we flew back every weekend. We went door to door with cameras taking pictures of all these apartments to put them online. I lived in their living rooms. And home by home, block by block, communities started growing. And people would visit New York and bring the idea back with them to their city.” – Brian Chesky, for The Atlantic

Be Patient: marketplaces take time

With a typical SaaS or e-commerce startup, you probably should reassess your market or model if you don’t see signs of traction after six to nine months. However, this timetable is way too accelerated for marketplaces. Considering you need to establish both buyer and seller communities, you will need more time to prove your business. It can take three years for a marketplace to get going.

Looking at a Version One portfolio company, the crowdfunding platform Indiegogo was founded in 2007, but its breakout year didn’t come until four years later.

This means that founders need to believe in their idea even when no one else does. But that doesn’t mean turning a blind eye to the market. You’ve got to continually look for small signals that you’re on the right track – such as increased word of mouth from early adopters, increased repeat usage from buyers, increased listings from sellers, and positive user feedback.

Just as important, investors need to stay patient: no two-sided marketplace is built overnight.

As a marketplace figures out how to bring buyers and sellers together and builds liquidity, the virtuous cycle starts kicking in. Growth quickly accelerates. The ultimate goal is that a successful startup grows into a big company. But as you begin to scale, you’ll need new strategies to keep the forward progress going.

1. Foster trust and safety

A certain level of trust is required for any transaction to take place. During the early days of your marketplace, you may have a small and passionate community. As such, trust and

safety are not significant concerns. However, as a marketplace grows and gains popularity, it will inevitably attract some bad actors. As one TechCrunch commenter wrote back in 2008, responding to an article on Airbnb:

“If this ever becomes mainstream, the whole thing will come crashing down. The kind of people that *DO* rob, abuse, rape and murder people will start using these systems, and that will spread legitimate fear, corrupting the whole thing. Pray that this remains underground, that’s the only way it can survive.”

Your job as a marketplace is to fight these bad actors proactively, so both buyers and sellers have confidence in the platform.

Transparency is one of the most effective ways to establish trust and credibility. This can be done with a rating system, user reviews, or testimonials. Some platforms act on this data to weed out the bad users (both buyers or sellers). For example, you’ll never see an Uber driver with a rating lower than three stars. Uber filters these drivers out, so customers don’t have to sift through driver reviews before getting a ride. On the flip side, riders are also rated, so drivers can feel safe with their pickups too.

Providing some level of guarantee — be it for service quality, delivery time, or payment — is critical for instilling trust on both sides. If your marketing claims you’ll be at your customer’s doorstep in 15 minutes, you need to make sure you can deliver on that promise. If a buyer never receives their item, you’ll need to be ready with a money-back guarantee. And, whenever the terms of the transaction are broken (on either side), you need to follow up with a very personal response.

CASE STUDY: AIRBNB’S TRUST & SAFETY TEAM

The following is extracted from Growth Hackers case study, Airbnb: The growth story you didn’t know.

Airbnb has managed to accomplish the once unimaginable: make people feel safe and secure when opening up their home to strangers or staying in someone else’s place. There have been some hiccups, company missteps, and security issues over the years, as can be expected with a platform that has more than 200 million guests since 2008 and 4 million properties listed worldwide (as of August 2017).

Here are some of the key ways that Airbnb has managed to overcome the inherent trust issue and instill confidence within their community:

1. Professional photographs did a lot to inspire trust on one side of the equation, as it helped to ensure that listings weren’t complete dumps, and also verified addresses of listed properties.

2. In 2011, Airbnb introduced Airbnb Social Connections, which leverages Facebook Connect. As a result, guests weren’t necessarily staying with total strangers, but friends of friends, people from the same school, or hosts that were recommended by friends.

3. In response to some specific incidents in 2011 (when host homes were ransacked and robbed), Airbnb created a dedicated Trust and Safety team that’s on call 24 hours a day, as well as a neighborhood hotline where neighbors can report any questions or concerns.

4. In 2012, Airbnb partnered with Lloyds of London to expand their guarantee to cover damages to host property from vandalism or theft. They now cover every booking with their $1,000,000 Host Guarantee (with some limitations and exceptions).

2. Support your power sellers

In addition to solving trust issues, the next step to scaling a marketplace is to support your power sellers — those sellers who earn a living off your marketplace. This approach may seem counter-intuitive for some startups that are typically used to pleasing end users (the buyers). But to be successful at scale, a marketplace needs good supply.

Anand Iyer, former Head of Product at Threadflip, stated that Threadflip initially focused more on the buyer experience but shifted strategy when the net promoter scores indicated that sellers needed more support. He describes the importance of focusing on supply/sellers:

“But for buyers, very little is actually out of the ordinary. Most people are used to buying or even ordering services online, either from Amazon or eBay. On the flipside, fewer people are used to shipping products, providing taxi service, or turning their home over to other occupants. For all these reasons, it’s crucial that marketplaces focus first on devising an elegant, instructive and — above all, easy — experience for suppliers.”

What are some of the ways a marketplace can support their top sellers? Here are some real-world examples:

eBay offers an official PowerSeller program where qualified sellers get priority customer support, unpaid item protection, a “top-rated Seller” designation, and other promotional offers. eBay does a great job organizing its local eBay On Location events to connect its sellers, provide additional learning/selling resources, and build a sense of community and identity around being an eBay seller.

Threadflip sends its sellers shipping supplies like boxes, and even free mannequins to help them display used clothes (after they discovered that people are most likely to buy used clothes they see on a mannequin rather than worn on a real person). In addition, Anand mentioned how Threadflip’s leadership team has regular one-on-one calls with top sellers to find out what they like about the experience and what Threadflip could be doing differently.

3. Develop an ecosystem

Think about add-on products, services, and experiences that give sellers a deeper connection with your marketplace. These are incredibly effective ways to differentiate the selling experience on your marketplace from other sites, and lock sellers into your site.

The first approach is to develop or offer these add-on products and services yourself. For example, Uber connects its drivers with exclusive leasing and financing offers. And Uber drivers who complete at least 100 trips each month can get a partner Fuel Card for gas and car maintenance purchases. The card offers a minimum 1.5% discount at participating gas stations/ mechanics and any charges are deducted from one’s Uber earnings. Other benefits are that the card doesn’t require a credit check and won’t impact the driver’s personal credit.

The second approach is to support the third-party services that spring up around your site. Marketplaces have a tremendous opportunity to scale into a platform with an entire ecosystem of value-added services and startups.

The success of Airbnb has sparked an ecosystem of value-added services, with startups offering property management services, guest screening, catering, and guest hop services for hosts. We saw a similar ecosystem emerge around eBay, with companies forming to take care of shipping, photos, insurance, and consignment.

Shopify, a SaaS provider of e-commerce stores for SMBs, has done an excellent job of understanding and formalizing the role that third-party developers play in enhancing Shopify’s overall value to sellers; they even brought on a Head of Apps and Third Party Developer Ecosystem. In the Shopify Apps Store, sellers can find third-party apps for selling, marketing, inventory management, customer support, shipping, reporting/analytics, and more.

4. Prevent leakage

With many marketplaces, there’s a real risk that buyers and sellers will settle the transaction off platform, preventing the marketplace from capturing any revenue from the transaction it worked so hard to put together. This is particularly true with “monogamous”, non-commoditized services. For example, once you find a good babysitter or doctor, you won’t want to look around for a different provider.

Charles Hudson provided a great analysis on the role of a well-designed rating system to combat leakage. In order for a rating system to have an impact, suppliers need to value their rating and buyers need to trust the quality of the rating system. For example, with Uber, drivers and riders are matched partly by their ratings and scores. This creates a strong incentive for both the provider and buyer to care about their score and keep the transaction on the platform.

5. Build a moat

As any marketplace gains popularity, its supply inevitably becomes less and less unique. From Boris’ first-hand experience, booksellers once were exclusive to AbeBooks, but then started to list with Amazon after it launched its marketplace. Uber and Lyft drivers typically begin with one service, but often end up driving for both.

And marketplace uniqueness can be diluted even when suppliers don’t intentionally leave. For example, Etsy struggles with design copying, including complaints of major retailers mass- producing products that look extremely similar to its handcrafted artisan designs.

When building a marketplace, it’s safe to assume that the uniqueness of your supply will fade over time as your suppliers seek out opportunities on other marketplaces and competitors look to grab a piece of the pie that you discovered.

You can adopt two strategies to minimize the impact of these competitive dynamics: protect the supply and protect buyer mindshare.

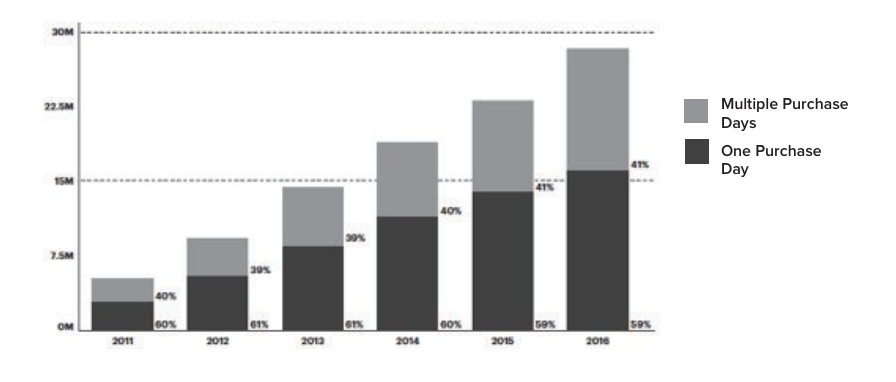

For example, Etsy has done an incredible job driving loyalty and repeat usage. As reported in its 2016 Annual Report, a large and growing number of Etsy buyers have made purchases on two or more days within the year.

Etsy’s Active Buyers by Purchase Type

Source: Etsy, 2016 Annual Report

Uber and Lyft have been able to lock in customer mindshare by becoming a home screen app on customer’s mobile phones. In the age of mobile where long-tail discovery (whether paid or organic) is less important, becoming a home screen app is critical. This trend is even stronger in those countries that have skipped the desktop altogether and gone straight to mobile.

If buyer mindshare is the key to building a moat against the competition, you need to have the right product mix to become a frequent destination for your customers. Then employ an aggressive mobile strategy to get on the home screen of as many buyers in your target group as possible.

Many entrepreneurs come up with a great idea for a marketplace, but then fail to find the right business model that will translate their activity into profits. The challenging part of monetizing a marketplace is that buyers and sellers are looking to complete transactions with one another, and fees introduce friction to the process. Whichever party is charged a fee will naturally try to conduct the transaction off-platform whenever possible.

Finding the right business model depends entirely on the characteristics of your market:

In general, most marketplaces take fees from their sellers — either through listing fees, lead generation fees, or transaction fees. The primary reason for monetizing the seller is simple: after you’ve seeded the marketplace with initial supply, demand becomes the limiting factor for marketplace growth. Charging buyers creates friction and limits their participation.

In this chapter, we’ll look at several of the most common monetization models: transaction fees, listing fees, end-user/buyer subscriptions, and seller services. We’ll also discuss how to find the right pricing/rake scheme.

Let’s start with the transaction fee, where the marketplace takes a cut of each transaction generated through the platform. It’s the fairest monetization model for suppliers and vendors, as they only pay a fee if and when they sell something.

This model encourages more suppliers to join the platform and thus increases the liquidity of the marketplace’s supply for two reasons: first, when you take away the upfront fee it’s easier to join, and second, if you only charge when a sale is made, you decrease the supplier’s risk of losing money. A transaction fee model also scales nicely: the more sales your platform generates, the more revenue you bring in.

By contrast, listing fees can have the opposite effect. Charging suppliers to list on your site will inevitably discourage some from listing. You might find your marketplace soon hits a ceiling where you can’t get any new suppliers to join. In addition, this model is less fair than transaction fees as listing fees hit all vendors equally — no matter how many sales they end up making on the site.

However, there are upsides to listing fees. They assure some level of quality control for a better end user/buyer experience. When sellers need to pay to list, they are more likely to list items with a high chance of selling, as well as invest time in each listing. In other words, you won’t have to worry about providers flooding your marketplace with low quality products and listings.

A recent trend has been for marketplaces to monetize by charging for optional seller services. In this case, you can make the base listing free and charge for enhanced services like better placement. The low entry cost encourages more suppliers to list (increasing liquidity), but revenue can be hard to come by since only a small percentage of suppliers will choose to pay for the better placement.

Such a freemium approach works best for companies that serve a huge market. Even if just a small percentage of suppliers pay for additional seller services, their base is so big that they can build a large business (e.g. Yelp). However, if you are tackling a niche market, you’ll never reach the scale necessary for a freemium model to work as the core source of revenue.

If we analyze Etsy’s 2016 Annual Report, we see that the company’s premium seller services are growing much faster than base transaction fees. Seller services cater toward the marketplace’s power sellers: promoted listings, direct checkout, shipping labels, etc. Revenue from these seller services overtook general marketplace transaction fees in 2015.

Since the average Etsy seller is too small to worry about fulfillment efficiency, these enhanced services take a higher rate from Etsy’s power users. This approach works very well for the company and community. By relying less on monetizing the smaller sellers, Etsy ensures that small sellers can afford to stay on the platform and contribute their unique inventory that buyers want. Etsy then takes a higher rate from the big sellers that can most afford it due to their scale.

This strategy means that Etsy doesn’t have to choose between unique inventory and monetization. They keep competitors at bay (because there’s no reason for the small sellers to leave) while growing the company’s take rate and revenues.

A business model based on transaction fees seems like the simplest and most effective approach for any marketplace. However, it’s hard to pull off when the service is delivered offline.

For example, Thumbtack is a platform that helps people find service professionals (photographers, painters, home contractors, movers, etc.). They started with a transaction fee model. But when a plumber goes to a customer’s house to fix a leaky faucet, it’s hard for Thumbtack to know when the service was performed and for how much. That makes charging by transaction fees tricky.

Furthermore, when a marketplace connects the buyer and seller before facilitating the transaction, it weakens the marketplace’s ability to capture value.

Thumbtack pivoted to a lead-based model: they make money by charging suppliers to contact customers. Vendors see all the details for a particular job (what, when, where) and if they feel they are a good fit, they pay Thumbtack to be introduced to compete for the job.

Keep in mind that the lead-based model only works with new connections (i.e. discovery). It’s ineffective in those cases where there’s a lot of repeat purchases from the same vendor.

In addition to a lead generation revenue model, there are some other strategies for service marketplaces. One approach is to stay as close to the transaction as possible. Elance offers hourly/project tracking and billing solutions that encourage both the provider (freelancer) and the customer to stay on the platform throughout the transaction.

The other approach is to productize the service as much as possible, with boxed offerings that include pre-defined scope, duration, pricing, deliverables, etc. This simplifies the end user experience, enabling them to complete a transaction in just a few clicks. The less back and forth between provider and customer, the more likely they are to complete the transaction on platform.

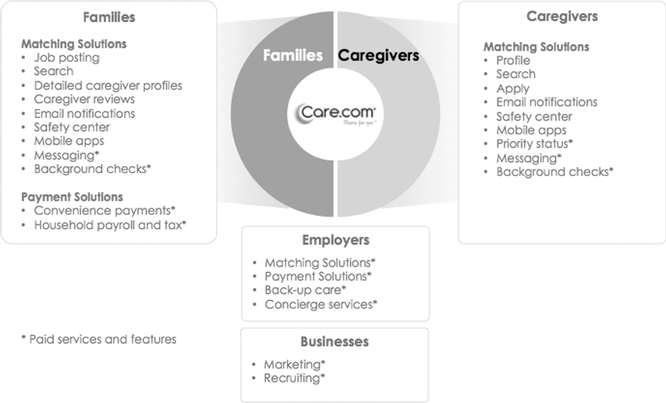

While most marketplaces extract a fee from their sellers, a few charge subscription fees to their buyers. Angie’s List and Care.com are the most notable examples.

Angie’s List charges buyers a membership fee in order to search the directory and view ratings. They also charge advertising fees to the seller.

Care.com has a freemium model, with value-added services on both sides of the marketplace. Families (buyers) need to pay a subscription fee to message a caregiver through the platform. Until you pay, identities are masked. Paying caregivers can move up in the search results, provide a preliminary background check, and get “priority notification” of opportunities.

Care.com: Breakdown of free and paid/premium services,

Source: Care.com IPO Prospectus

There are a few risks with the subscription model:

Care.com expressed this challenge in their prospectus:

“Currently, most of our paid memberships are monthly memberships, and the average paid membership length for our consumer matching solutions is approximately seven months. As a result, we must regularly replace paying members who allow their membership to lapse with new paying members either by converting existing non-paying members or by attracting new members to our service.”

Bill Gurley’s article “A Rake Too Far: Optimal Platform Pricing Strategy” is recommended reading for any startup trying to determine their pricing strategy. He begins by saying:

“It may seem tautological that a higher rake is always better – that charging more would be better than charging less. But in fact, the opposite may often be true. The most dangerous strategy for any platform company is to price too high – to charge a greedy and overzealous rake that could serve to undermine the whole point of having a platform in the first place.”

What’s the problem with levying too high a fee? First, as Gurley explains, if you charge an excessive rate, that cost ultimately gets passed along to the consumer and the “pricing of items in your marketplace are now unnaturally high.” Second, high rakes give suppliers a reason to look elsewhere and you become vulnerable to competitors from below.

Here’s a telling example: in the late 1990s companies like Expedia and Travelocity were the online travel leaders in Europe, and they took a rake over 30% with certain packages. This left an opening for Booking.com (part of Priceline Group) to come in with a lower 10% rake and sign up nearly every small hotel in Europe. This resulted in greater supply and selection for consumers – and Booking.com is the undisputed leader today.

What’s even more interesting is that the average rake at Booking.com is higher today since merchants bid up their rake for better placement, similar to the Google Ads model.

Just like with Etsy’s Premium Seller Services model, this approach offers the best of both worlds: low starting fees that encourage broad supplier adoption (and supply liquidity) along with added revenue from those suppliers who want more exposure, or whatever other enhanced services you offer. You won’t turn anyone away due to high fees, but can still boost your take as suppliers compete with one another.

At their core, every marketplace is similar. On one side, there’s a seller (supply), on the other side a buyer (demand). The marketplace acts as an intermediary to bring these two sides together. But there can be a lot of innovation in how a marketplace handles these transactions, takes care of its seller and buyer communities, and approaches monetization.

As the industry matures, we’re seeing new marketplace models emerge, including on-demand, managed, community-driven, SaaS-enabled, and decentralized. Here’s a quick look at each kind.

The widespread use of smartphones has helped create a consumer culture that’s conditioned to expect anything and everything on-demand. With the “uberification” of many different markets and services, the smartphone has turned into a remote control that can summon anything from cookies to legal services.

These on-demand marketplaces match jobs with independent contractors on the fly, supplying labor service or products on demand. For example, there’s Instacart to buy and deliver groceries, TaskRabbit for odd jobs, and the list continues.

In many ways, today’s on-demand economy is a continuation of the sharing economy, or collaborative consumption — exemplified by Airbnb, where people turn their underused assets (i.e. home, bed, car, etc.) into a source of revenue. Now, with on-demand services, people aren’t renting out their assets, but instead their spare time.

While entrepreneurs and investors were once excited by the massive opportunity, it’s important to realize that the on-demand service model that lifted Uber’s valuation to a high of $70B won’t work for every vertical. In many cases, the hype once driving on-demand marketplaces has come and gone.

The service marketplaces that have been able to break through and continue to scale follow three key principles:

1. Underlying Commoditized Services

When it comes to hiring a ride, most of us are happy as long as a driver brings us from Point A to Point B in a clean car without getting lost. This makes us pretty flexible in terms of who delivers the service. For more complex services — e.g. haircuts, babysitting, and legal/medical advice — it’s harder for customers to accept the idea that somebody at random will show up

each time. We develop preferences, and like to stick with one provider once they earn our trust.

2. High purchase frequency

The best marketplaces have high purchase frequency and regular usage. For city dwellers and frequent travelers, taxis are used on a daily, or at least weekly, basis. Few other services have such a high purchase frequency. On top of this, Uber also enjoys significant spillover effects as travelers move from one location to another.

With high frequency use cases, customers fall into the habit of using the same service as long as they’re satisfied. This makes it easy for a startup to become the “home screen app” for that particular use case. By contrast, it is much harder to retain customer mindshare with lower purchase frequencies. If customers need a yard cleanup just two times a year, they’re more likely to begin the research process over again each time.

3. True on-demand use case

Many of the services that fall into the on-demand mobile services category aren’t actually “on- demand.” In most cases you don’t need a cleaning service or house painter to show up within minutes, or even the same day. But, taxis are a different story.

A true on-demand marketplace requires sufficient liquidity on the supply side. Without enough available drivers in a car service marketplace, customers will be left waiting on the curb.

This creates a large barrier to enter the market, since a new competitor needs to launch with hundreds of providers, not just a handful.

By contrast, when services can be delivered with more flexible timing, it’s easier for competitors to enter a vertical or new location and there’s less of a winner takes all dynamic. As such, we can expect just one or two major players for a true on-demand service, while less time-sensitive markets will be crowded with smaller companies.

Over the past few years, we’ve seen the emergence of managed marketplaces. These are marketplaces that don’t just connect buyers and sellers, but take on additional parts of the value chain to deliver a better overall experience. With startups like thredUP, Luxe, Opendoor, and Real Real, managed marketplaces have been a hot category for VC investment.

These types of marketplaces can be game-changers in their categories, particularly when dealing with high-value ticket items. By adding managed services, marketplaces can create new demand by helping buyers overcome the trust issues associated with most peer-to-peer marketplaces. There’s a big difference in trust levels when looking for elder-care services on a managed marketplace like Honor versus searching on Craiglist. As Anand Iyer wrote, trust, safety, and risk management are basically tables stakes now for a managed marketplace: “what draws most consumers to a managed marketplace is how the marketplace manages trust.”

Borrowing from Ezra Galston’s “Anatomy of a Managed Marketplace” and Anand Iyer’s “The Evolution of Managed Marketplaces,” we believe that managed marketplaces share three key characteristics:

thredUP offers an interesting case study in finding the right managed model. thredUP works with a lot of children’s and mom’s clothing — not exactly big ticket items. It’s a great market opportunity for re-sale, because as any parent knows, it’s easy to over-spend on kids clothing and items are worn for only one season (or less). Moms were taking photos and cataloging their clothing, but soon they didn’t want to do it any more. Photographing clothes is a hassle.

The company considered taking on these tasks to help out their sellers, but were advised against taking any inventory. It was too risky, complex, and expensive for such small ticket items. However, thredUP understood how much their sellers needed these service and went ahead with a managed model. People can order a bag, throw their things in, and thredUP takes care of the rest. After switching to a managed model, their business took off again. Inventory quality and variety has improved, making the marketplace more attractive to buyers.

The takeaway? Sometimes it’s okay to deviate from conventional wisdom. thredUP listened to what their users needed and delivered on those needs (and only those needs — you don’t want to add costs by taking on more than what’s necessary).

The core question is: how much value can you unlock by managing parts of the marketplace value without raising the risk profile too much?

Managed Marketplaces: Who sets the pricing?

Another element of a managed marketplace is when the platform itself sets the pricing, instead of the sellers. In a traditional marketplace, sellers define their own prices. A great example is Sidecar vs. Uber/Lyft where these ride-sharing companies adopted different pricing strategies to target a different consumer segment.

Uber and Lyft standardized their pricing and service offerings. Consumers simply push a button and a car shows up. Every Uber driver will charge you the same rate to take you from Point A to Point B. By contrast, Sidecar drivers set their own rates. You had a better chance of finding a cheaper ride with Sidecar, but you needed to spend time browsing through a lot of choices (lowest fees, larger cars, etc.) in order to find what you want. Ultimately, Sidecar’s “Wild West” model failed — letting supply set a price for a commoditized, undifferentiated service just doesn’t make sense.

Some marketplaces leverage the community of buyers and sellers to create a unique differentiator. Here, buyers and sellers visit the marketplace not just to complete a transaction, but also for a sense of identity and belonging. They meet and form communities with others who have similar interests.

Etsy is a prime example of a marketplace that has built a business around community and culture. From Etsy’s 10th anniversary blog: “Over time, Etsy has come to represent something even more powerful: an alternative to traditional commerce and a different, people-centered model for doing business.” Etsy calls itself more than a marketplace: “we’re a community of artists, creators, collectors, thinkers and doers.”

To support their community, Etsy added team functionality to its marketplace, letting users (sellers and buyers) create and join teams around shared interests. They also host official craft nights in Brooklyn and other local meetups.

Lyft has thus far been able to hold its own by building a strong culture and sense of identity around its drivers. Driver meetups and community rallies are a longstanding Lyft tradition. There’s also a private Facebook group (the Driver Lounge) where Lyft drivers can meet other local drivers, share stories, connect over common interests, and organize local events. Such efforts pay off in the form of better brand loyalty for the drivers, and a more unique culture for riders.

And at Boris’ old company, AbeBooks, the seller community was incredibly active and the marketplace gave them a place to come together as booklovers. To help foster this sense of community, AbeBooks created online community forums, which evolved into book clubs, science fiction groups, collector groups, help with forgotten authors, titles, etc.

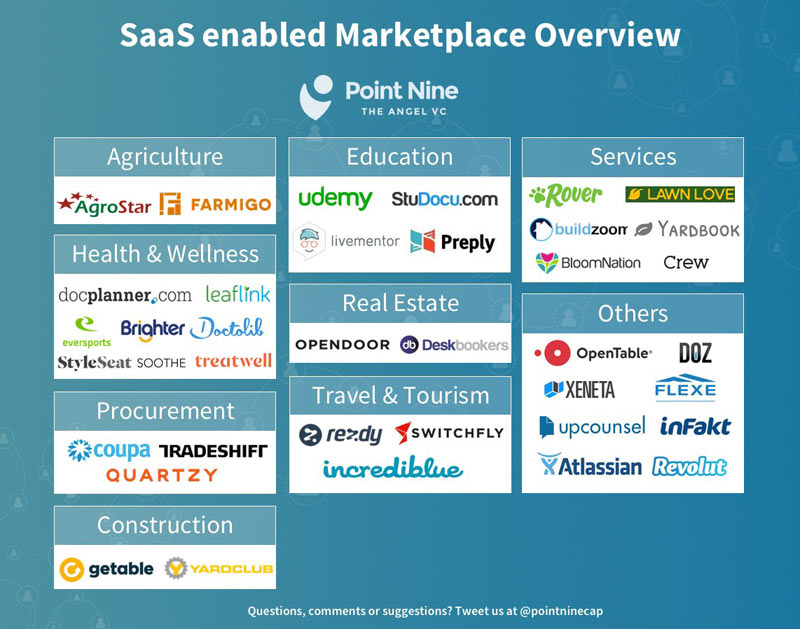

Today we’re seeing a new segment of companies that offer SaaS tools with the ultimate plan of building a marketplace. Such companies attract users (either customers or sellers) with a useful and typically free tool, then encourage them to participate in the marketplace. Chris Dixon described this approach, “come for the tool, stay for the network.”

Source: Point Nine Capital

SaaS-enabled marketplaces can be either B2B, B2C or C2C and the SaaS component can be offered to the demand and/or supply side. Point Nine Capital mapped out a high-level overview of the SaaS-enabled marketplace ecosystem.

OpenTable is a prime example. They offer various front-of-house software tools for restaurants, like seating management. While OpenTable may be a leader in online reservations today, these kinds of business tools attracted restaurants and gave them an easy way to list and manage their incoming reservations (thus helping OpenTable build liquidity).

Zenefits is another example. They offer free benefits software for HR/business, and make their money off commissions when someone buys insurance from their marketplace. Free software can be a strong go-to-market strategy, as Tomasz Tunguz described:

“Free good software spreads quickly, enabling rapid customer acquisition. In competitive markets or when pursuing customers that have been expensive to acquire, free software creates a clear, and often defensible, competitive distribution advantage.”

However, developing a SaaS-enabled marketplace requires certain factors to be aligned. First, you need to make sure that the consumers or businesses that sign up for your tool will be just as willing to join and use your marketplace. This strategy will only work if the marketplace is complementary to the tool. Second, you may have to contend with some sellers who want to use your tool, but aren’t too eager to join a marketplace that puts them in competition with others.

And third, market dynamics require ongoing use of the marketplace. OpenTable has succeeded because people are always looking for a new restaurant to try, so the marketplace provides continuous value. This approach won’t work in those cases where consumers prefer a “monogamous relationship” like with doctors.

Over the past few years, we have been closely following the evolution of blockchain technology and looking at the potential impact that blockchain will have on the marketplace landscape.

In terms of decentralized marketplaces today, OpenBazaar is really the only game in town for buying/selling physical products. It’s an open source project to create a peer-to-peer commerce network using Bitcoin. With OpenBazaar, there’s no middle man: the platform connects buyers and sellers directly. And since there’s no one in the middle of a transaction, there are no fees and no restrictions on what goods can be listed and sold. OpenBazaar realizes blockchain’s promise to bring power back to the edge (aka the users).

A decentralized marketplace is an interesting proposition and we are eagerly watching how new marketplaces based on blockchain may disrupt industries. However, the big question is if a decentralized platform will be able to create the same great customer experience that we’ve grown accustomed to on centralized marketplaces.

Can a decentralized platform offer the same kind of UX, conflict resolution tools, and customer service? And how much do these things this matter? Are customers willing to pay a fee for a smoother, sleeker, more trustworthy experience?

The other question is will decentralized marketplaces be pushed to the fringe and just attract buyers and sellers for illicit goods? If so, just how scalable are these kinds of use cases?

These are important questions and we’re still not certain in what ways a decentralized marketplace can disrupt a well-functioning centralized marketplace. Will a decentralized marketplace replace a centralized one, or will blockchain technology become a part of an existing marketplace?

While there may be challenges associated with replacing well-established marketplaces, tremendous opportunities exist to enable something new and create a brand new generation of marketplaces. Prime candidates are marketplaces for digital assets that allow anyone in the world to conduct a transaction with any other participant without having a central instance manage the transaction (e.g. payment settlement, etc.). Examples include:

In these decentralized marketplaces, transactions between marketplace participants are settled using the marketplace token. As the marketplace’s usage grows, those tokens will hopefully further appreciate, making participation from the supply side even more attractive. This will solve the chicken and egg dynamic that can pose such a problem for young marketplaces. It will also create strong network effects as the platform grows, resulting in a winner-takes-all where the biggest player is way bigger than its competitors.

This space is rapidly evolving and no doubt, the players, models and trends will be vastly different just a few months from now. It’s an area we’ll be watching closely.

As you grow, it’s important to understand how the business is performing: if your model is financially viable, what’s working well, and what needs to be changed. But traditional business metrics and KPI dashboards don’t necessarily capture the key factors that drive marketplace performance and health.

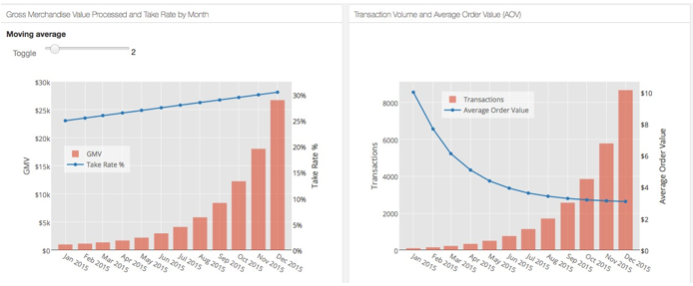

Christoph Janz at Point Nine Capital created a KPI dashboard for early-stage SaaS. Inspired by this, we have put together a KPI template for marketplaces.

You can access the Marketplace KPI Template via the Google doc here (make a copy of it and then you can edit away).

Special thanks to Vijay Nagappan of MHS Capital for bringing the KPI template to life and visualizing these KPIs using Plot.ly and Keen.io dashboards. Vijay created four starter dashboards for summary, supplier side, demand side, and then a mashup of supplier side and demand side data to see if there are any interesting trends. If you’re interested in creating your own visualizations and dashboards, check out Vijay’s post — which includes links to Keen.io’s templates, Plot.ly’s Web GUI, Plot.ly’s Python APIs and much more.

Samples of KPI dashboards created by Vijay Nagappan, MHS Capital, using Plot.ly and Keen.io

Our Marketplace KPI Dashboard, Available for download here

The dashboard is separated into three dimensions of your business’ efficacy: 1) overall marketplace metrics, 2) seller/supplier metrics, and 3) buyer metrics.

1. Overall Marketplace Metrics

Gross merchandise volume (GMV) is the total sales dollar value for goods sold or services purchased through the marketplace over a certain time. Given that GMV is one of the most important marketplace KPIs, founders should track its growth rate on a monthly and yearly basis, and understand its makeup by customer acquisition channel. With GMV and the total number of transactions, we can compute the average order value (AOV) since:

GMV = # of Transactions * AOV

Revenue is the income that the company receives from facilitating connections in the marketplace. It comes in the form of transaction fees, listing fees, and/or the offering of premium seller/supplier services. With revenue and GMV, we can calculate take rate via:

Revenue = GMV * Take Rate

In addition to take rate, we can evaluate business efficacy by calculating the total customer acquisition cost (CAC) of buyers and sellers/suppliers as a percentage of revenue.

2. Seller/Supplier Metrics

Supplier metrics are categorized into general and engagement KPIs, for example:

General KPIs

Engagement KPIs on the supplier side

Engagement KPIs are most important to the supplier side, so make sure you track these at the very least:

3. Buyer Metrics

Similar to supplier metrics, we can categorize these into general and engagement:

General KPIs

Engagement KPIs on the buyer side

4. Measuring Liquidity

The first marketplace in a category to reach liquidity wins (it’s winner takes all: we’ll discuss this further in Chapter 7, Working with Investors). Marketplaces strengthen with scale and scale comes from liquidity. Until you reach liquidity, you’re vulnerable. After, you have the opportunity for dominance.

Liquidity is the reasonable expectation of selling something you list or finding what you’re looking for. Liquidity indicates how successful the marketplace is for sellers and buyers.

How long does it take to make a transaction? What percentage of goods or services are purchased daily?

So how do you measure liquidity? Consider two numbers: supply liquidity and buyer liquidity.

As you’re building your marketplace, consider which tools and technology to leverage. There’s no reason to reinvent the wheel as new infrastructure solutions are emerging to help facilitate transactions on your platform, including: payment software, background checks, shipping and fulfillment solutions, and data privacy.

With help from the Marketplaces Facebook Group, we have curated a list of recommended B2B tools by marketplace founders.

You’ll see that most of these tools are relevant and useful to any software startup, and not just marketplace companies. However, a marketplace is unique in that it deals with distributed supply (and demand) and there aren’t many marketplace-specific tools out there yet to help with this.

With that said, some of the products on our list are designed to help third parties provide services and sell products: Shippo (a Version One investment), ShareTribe and Near Me, Stripe Connect and previously, Balanced (which has since shut down but most customers have moved over to Stripe).

Here’s the bottom line: leverage good tools wherever you can, so you can focus on more valuable tasks like making connections and refining your business model.

Two of the most frequently asked questions at any startup event or investor panel, are “What do investors look for in a marketplace startup?” and “How to investors value a startup?” While answering these questions is often more art than science, we’ll shed some light on how we evaluate companies at Version One.

As mentioned earlier, Bill Gurley outlined a list of 10 factors to consider when evaluating marketplaces. If you haven’t read his post already, we strongly encourage you to do so.

And, as we mentioned in Chapter 1, the six most important factors for us are:

These aren’t the only factors that lead to success. For instance, other VCs feel that a marketplace with less frequency of purchase can be offset by a high AOV. However, for us, these six points create the foundation of our thesis and we’re more likely to dive into a startup’s data if we’re aligned at this higher level.

What type of traction do we want to see in order to invest?

The answer is, “it depends.” Every startup is different and we conduct our due diligence on a case-by-case basis. Yet, with that said, there is a general set of questions we use to evaluate the dynamics of a marketplace and assess a startup’s product-market fit.

Using our portfolio company Headout as an example, here’s a sampling of questions we may ask a potential marketplace startup. You’ll see that many of these questions are inspired by the metrics/KPI data we discussed in Chapter 5.

While some of the specific details may vary based on market (Headout is a travel/experience oriented marketplace), any founder can use this as a primer for building out his or her own metrics. As you can imagine, there are many more questions to ask but these serve as a good conversation starter between Version One and the entrepreneurs we meet, helping us develop a stronger thesis faster.

On buyers (e.g. travellers/tourists):

On suppliers (i.e. vendors):

In general:

Wherever applicable, we ask for average values (i.e. spend, price, buyers, suppliers, time) and absolute numbers and distributions.

Together with Point Nine Capital we put together a framework that links milestones with fundraising stages for marketplace companies. You can download a copy as a Google Sheet or in stylized Marketplace Napkin form. Note that Point Nine has also created a great chart for SaaS companies as well.

As always, there are exceptions to every rule. Some startups can raise a big round early on (for example, when the founding team already has large exits under their belts), while other startups feel the frustration of struggling to raise money even though they’re hitting every milestone on the chart. But we hope this chart can be a useful framework for founders to understand what benchmarks we as marketplace investors look for, and when we look for them.

Marketplace Funding in 2018

Source: Point Nine Capital and Version One, Available as a Google Sheet or Marketplace Napkin

Ultimately, we invest in smart founders — ones who are incredibly passionate, ambitious, and talented. But these founders are also data-driven, no matter how early the company is. We want to know that an entrepreneur has a good hold on all KPIs, i.e. the knobs and levers that he or she can turn and pull in order to engage users and scale the business. In fact, the founders we have been most impressed with have been able to present their data quickly and communicate insights clearly.

The main multiple we like to use for marketplace businesses is GMV. Our rule of thumb is that marketplaces at scale are valued at roughly 1x annualized GMV (typically about 6-8x annual revenue). These are for marketplaces that are growing fast and are category leaders.

Our assumptions for this valuation:

Taking Etsy as an example, after it went public…

Source: Bessemer Venture Partners, SlideShare “Valuations: What is happening and does it matter?”

Etsy had a market cap of about $1.86B as of July 13, 2015 with a revenue multiple of 6.8 and a GMV multiple of 0.76. But note that its GMV multiple was as high as 1.7 immediately following its IPO.

Bessemer offers a good overview of current valuations for different business models: SaaS, marketplaces, consumer, and e-commerce.

You can see in their chart above that marketplaces get some of the highest revenue multiples because of their operational leverage and high defensibility at scale.

While there’s certainly a lot of enthusiasm surrounding marketplace valuations, it’s important to realize that there’s a large (and potentially sobering) disconnect between the valuations for public and private consumer marketplaces. This fact was recently pointed out by Mahesh.

Vellanki of Redpoint Ventures, after he took a deep look into six metrics for marketplaces, including enterprise value, revenue multiples, and revenue growth. His conclusion:

“What I see are large scale, profitable and fast growing marketplace businesses in exciting markets that are worth shockingly little relative to private comps. I’m both excited and scared to see how things will shake out.”

These calculations apply to marketplaces that have already solved the chicken-and- egg problem, reached liquidity, and have become a category leader. But you might be wondering how to value your early-stage marketplace startup.

Early-stage companies are valued very differently. In this case, metrics don’t count- we’re evaluating the team, idea, and vision. Then as the marketplace starts to scale fast, the multiples are often very high because growth is high as well. But you need to understand that your marketplace will ultimately be valued at 1x GMV.

If you’re a founder of an early-stage marketplace, you should focus on two things:

1. Growing GMV

2. Proving out take-rate

Sometimes we see entrepreneurs who pitch impressive GMV numbers, but haven’t proven that they can ultimately get to a significant take rate. For example, a marketplace that generates leads instead of being part of the transaction might have a take rate as low as 2-3%. In this case, the GMV needs to be 5x bigger than a comparable marketplace with a 10-15% take rate.

The bottom line? Don’t wait too long to prove out your monetization.

It’s typically a binary outcome for marketplace start-ups at the beginning: either you figure out the chicken-and-egg problem or you don’t. But, marketplaces can face a binary outcome at the other end too: either you scale your marketplace into a large, stand-alone company that can go public, or you find yourself with few other exit options.

This reality is quite different than the exit opportunities for SaaS companies. It’s common for SaaS start-ups to be bought by large enterprises for the technology/product. The acquiring company can just plug that product into their existing distribution channel to help round out their current product suite and grab more market share.