The Blockchain is such an innovative and fundamentally transformative technology, but Bitcoin and Blockchain apps…

Crypto / Blockchain

Over 10 years since its inception, Bitcoin is now firmly established as the preeminent digital store of value (SoV). I believe this is because Bitcoin dominates among crypto assets on the axes that matter most for fulfilling this digital gold-like function: A clear and reliable monetary policy: only 21 million BTC will ever exist Security: […]

The Blockchain is such an innovative and fundamentally transformative technology, but Bitcoin and Blockchain apps…

There is not doubt that Bitcoin / the blockchain is a revolutionary technology. Once implemented,…

Over 10 years since its inception, Bitcoin is now firmly established as the preeminent digital store of value (SoV). I believe this is because Bitcoin dominates among crypto assets on the axes that matter most for fulfilling this digital gold-like function:

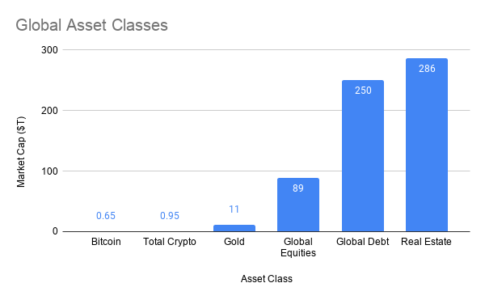

I recommend reading Bitcoin for the Open Minded Skeptic by Paradigm’s Matt Huang to better understand Bitcoin’s product market fit as a global SoV. What’s crazy is that even if that’s all Bitcoin ever becomes, it’s still only at a fraction of its ultimate value. Below are current market cap estimates for competing SoV products. Bitcoin is still not even visible on the chart!

And while having a digital SoV is itself world-changing, the question since time immemorial for Bitcoiners remains: cool, but can it do anything else? This question is what ultimately led Vitalik Buterin to launch Ethereum (followed by a wave of other smart contract platforms over the last 5 years).

Up until recently, the answer has been not much. But slowly, we’re seeing some promising signs of using the dominant security and liquidity of the Bitcoin base chain to better secure smart contracts and other assets like non-fungible tokens (NFTs).

The most exciting approach to date is happening on the Lightning Network, which l detail in full here. Projects like Sphinx already have live apps where users can send private messages and stream sats for podcasts all over Lightning. This model of building layered protocols like Lightning on top of Bitcoin has always intuitively made sense to me and appears most analogous to what played out in the first Internet wave (ala TCP/IP).

And yet, there’s no denying that the amount of innovation on smart contract platforms, namely Ethereum, has completely dwarfed the Bitcoin layered approach to date. The amount of permissionless innovation that happened last summer on Ethereum based DeFi was truly wild to witness. The developer network effects there are very real. And so, as I postulated in this post, it also makes a lot of sense that bitcoin may end up serving as a strong collateral type embedded within Ethereum and other smart contract platforms. This is precisely what we’ve seen with various bridge approaches like wrapped Bitcoin (WBTC) and, to a lesser extent, tBTC and Ren. Given the apparent product market for both Bitcoin (as digital value) and Ethereum (as a distributed computer actually used by developers), I wouldn’t be surprised to see this trend continue to thrive.

But what if there was another way to leverage Bitcoin’s security and liquidity more directly for Web 3.0 applications and smart contracts? Enter Stacks (formerly known as Blockstack), which is today releasing the Stacks 2.0 blockchain. Stacks 2.0 pioneers a novel consensus mechanism, Proof Transfer (PoX), which uses bitcoin to bootstrap to the security of a new chain. PoX is a variant of another consensus mechanism called Proof of Burn (PoB) whereby holders of one blockchain’s native digital asset demonstrate sending it to a dead address (i.e. burning it) to receive assets on a new chain. In PoX, instead of burning the bitcoin, miners transfer the asset to holders of STX (the native digital asset of the Stacks 2.0 chain). You can read a good ELI5 version of how the mechanism works here.

The critical insight behind PoX is that electricity need only be converted from physical to digital form once via the dominant PoW chain (Bitcoin). And the bitcoin created from this process can then be used natively as a currency to secure other chains. Pretty clever if you ask me! And the tools for developers to build Web 3.0 apps on top of this new Bitcoin-backed chain already exist today, complete with a relatively straightforward and secure programming language called Clarity (which is also used by projects like Algorand). Sample applications include: Bitcoin backed DeFi apps, identity/naming services, and decentralized social media services. Here’s a list of initial projects.

As with all user owned Internet projects, the proof will be in attracting actual developers and entrepreneurs to build network effects on top of the platform. While it remains to be seen if Blockstack will ultimately garner the traction of projects like Ethereum, there’s no doubt that they have a clear path to a secure chain from day one and will likely attract Bitcoiners interested in earning yield on their BTC holdings without needing to trust various third parties or bridges. We at Version One are ourselves small investors in the project and plan to experiment with staking our STX to earn BTC rewards. If you’d like to learn more about participating in stacks, you should check out today’s launch event.

We’ll be posting more about the future of Web 3 and user owned Internet projects in the coming weeks, as this remains a top priority investment theme at Version One. If you’re working on a related project, then please reach out!

Portfolio

It’s been an eventful quarter (when has it not?), and somehow we’ve already crossed the halfway mark of 2025. We wanted to take a moment to highlight just a few of the wins, milestones, and momentum we’ve seen this past quarter. As always, there’s a whole lot happening behind the scenes that can’t be shared […]

The V1 family kicked off the new year with fresh energy and no shortage of…

At the end of Q1, we anticipated that a tech sector slowdown is ideal for…