The Blockchain is such an innovative and fundamentally transformative technology, but Bitcoin and Blockchain apps…

Energy/Climate, Crypto / Blockchain

I’ve spent the majority of the last decade working in two fields: solar energy and cryptocurrency. At first blush, these may seem pretty different. In my mind, however, they have a lot in common and are converging by the day. Both are based on principles of decentralization. Both are disrupting antiquated, opaque industries with large […]

The Blockchain is such an innovative and fundamentally transformative technology, but Bitcoin and Blockchain apps…

Over 10 years since its inception, Bitcoin is now firmly established as the preeminent digital…

I’ve spent the majority of the last decade working in two fields: solar energy and cryptocurrency. At first blush, these may seem pretty different. In my mind, however, they have a lot in common and are converging by the day.

Both are based on principles of decentralization. Both are disrupting antiquated, opaque industries with large societal externalities (energy and banking). Both are following exponential adoption curves. And at an even more basic level: bitcoin is energy. The process of mining, which secures the Bitcoin blockchain and mints new bitcoin, is the process of converting electricity to work or value. You can read more about how mining works here.

Increasingly, that electricity is coming from solar. As I detailed in this post and as is eloquently chronicled by energy analyst Ramez Naam here, the cost of solar energy has fallen off a cliff over the last decade to the point where it’s already cheaper to build new solar than to operate existing coal/natural gas plants in many parts of the world. This is a very big deal! As solar becomes an increasingly large part of our electricity supply, mining becomes a process for directly converting the sun’s energy to value stored as bitcoin.

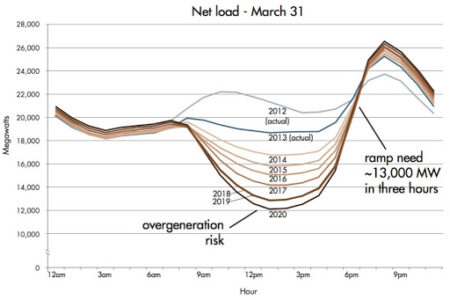

The only remaining challenge with solar, however, is availability. This is both a frequent daily and infrequent, unpredictable challenge. Every day, there’s a known mismatch between when solar panels produce the most (midday) and when demand is highest (early evening when people return home from work). This mismatch was famously described by the National Renewable Energy Laboratory (NREL) as the “duck curve” based on it’s duck-like appearance. This short video explains the challenge well.

Source: NREL

Source: NREL

Meanwhile, there are also less predictable seasonal challenges. The grid typically only needs a low amount of baseload energy, but occasionally, demand spikes massively. These spikes can be difficult to forecast with granularity. Venture backed companies like EnPowered offer services to do just that. Avoiding only a small handful of spikes each year can save large companies millions of dollars.

Today, there are three main solutions to these problems:

1) Peaker Plants: grid operators can turn on natural gas “peaker plants” for peak hours. These plants, though, are extremely inefficient and expensive to run for these short periods of time.

2) Demand Response: grid operators pay end users to shut down assets during peak periods, thus decreasing the total amount of energy needed on the grid. Conventional demand response is not a bad option, but is expensive, and not particularly efficient or granular in control (e.g. imagine trying to shut down an entire factory for exactly 2 hours).

3) Storage: As the cost of batteries continues to fall, utilities are increasingly building edge of grid storage instead of new peaker plants. As Ark Invest details in this report, Li batteries are already cheaper than peaker plants used < 10% of the time (the average utilization rate for peakers) and will soon beat peakers used < 25%. This is very exciting as batteries appear to be on a similar (though slightly less steep) cost curve as solar.

Bitcoin mining offers a fourth option: real-time, virtual batteries that can be turned on or off at a moment’s notice to provide both conventional Demand Response (DR) as well as “Supply Response (SR) .” On the DR side, the grid can pay Bitcoin miners to shut down whenever demand spikes, thus smoothing out the duck’s head.

As long as the cost /kWh paid by the utility to Bitcoin miners is above their expected value for BTC/kWh mined, then it always makes sense to shut down BTC miners in real-time as they receive favorable price signals. What’s more, BTC miners can be shut down at an extremely granular rate. If only 40% of a miner’s demand needs to be curtailed for 2 hours, then a farm can shut down exactly 40% of their machines for exactly 2 hours.

And unlike other critical cloud computing services (e.g. AWS), there are no end customers relying on maintaining a specific VM instance. Hashrate is essentially fungible, so you can always shut down miners whenever it’s economical to do so. As Brandon Arvanaghi of Layer1 explains in this thread, this DR property effectively turns BTC miners into virtual power plants.

And while using BTC miners for DR makes a ton of sense in the short term, the long term value, according to Andrew Myers of Satoshi Energy, may be in what he calls “supply response.” As more solar and wind flood the grid, we’ll see negative electricity prices more frequently – i.e. the belly of our duck will only grow bigger. Unless we can find some reliable, productive use of the excess energy that is always available as a buyer of last resort. Which is what Bitcoin miners are poised to become. In short, they’ll provide a price floor for electricity by eating the duck’s belly, making it easier for both grid and DER operators to plan, which ultimately increases market efficiency.

One key short term question revolves around the amortized CAPEX of a Li battery vs. a Bitcoin miner. If we are truly approaching the limits of Moore’s Law, then that means the need to replace BTC miners will become less and less over time (meaning less total cost) while Lithium ion batteries will still wear out every 5 or so years. This could easily shift the value proposition further toward investing in BTC mining vs. storage until some new breakthrough battery technology is available, though some co-optimization between the two seems most likely.

Many entrepreneurs are starting to recognize this arbitrage opportunity. The aforementioned Layer 1 is taking a full stack approach and building their own custom chips, cooling hardware, and enrolling directly in demand response programs on the Texas grid (ERCOT). Satoshi Energy is building a financial platform to turn existing energy asset owners into “behind the meter” miners. Rosseau and Crusoe are going after the flared natural gas market (with the potential to expand to other stranded energy assets).

The second order implications of this realization could be quite large. For one, I think we’ll see many grids overbuilding solar or wind capacity instead of investing in or operating peaker gas plants because they know that Bitcoin miners will always exist as a flexible buyer of last resort. What’s more, this will further accelerate the virtuous feedback loop for both solar and Bitcoin as the volume of solar panels/inverters and ASICS produced increases, pushing both further down their respective learning cost curves.

And as more energy production moves to the edge of the grid – when we all become “prosumers” – I think we’ll see a wave of software startups designed to help all grid participants decide what to do with each electron produced: use it, sell it to the grid, sell it to a neighbor, store it, or perhaps mine bitcoin.

The big questions I’m still trying to wrap my head around are:

1) What type of financing makes sense for these projects? Will it be mostly bespoke project finance like we’ve seen in solar/wind? Or are there more venture backable software/marketplace opportunities available?

2) What happens when the cost of storage (either Lithium Ion or some new tech) becomes ridiculously cheap as well? How much market will be left for virtual “bitcoin batteries?”

3) Can you expand these virtual power plant offerings to other compute heavy activities like machine learning?

If you have opinions on the above questions or if you’re working on projects, particularly software based, that will manage the transition to a renewable energy + Bitcoin powered grid, please reach out!

Also, note that while I titled the piece the “Solar-Bitcoin” convergence, I could have easily called it the “Renewables-Bitcoin” convergence, as other energy sources like wind, hydro, or geothermal will remain the lowest levelized cost of energy (LCOE) for many parts of the world. I picked solar both because of its generalizability and because that’s where I focus most of my personal research.

Thanks to Alex Pruden, Ali Chehrehsaz, Andrew Myers, and Sarah Adams for feedback on this piece.

News

Happy New Year! The final quarter of 2025 brought meaningful momentum across the V1 portfolio, with founders closing Q4 strong and building toward an even bigger 2026. We’re excited to carry that progress into the months ahead. Before we fully shift our focus to what’s next, here’s a look back at a few highlights and […]

Yet another year has flown by. This past quarter was a busy one, which should…

The V1 family kicked off the new year with fresh energy and no shortage of…