When it comes to putting together your pitch deck and preparing for an investor meeting,…

Entrepreneurship

There are many great articles that outline what an entrepreneur should cover during a pitch, but very few discuss how to deliver that message in a compelling manner. That’s why I wrote, “A good story is the key to any pitch”, earlier this year. I thought I’d revisit this topic with my visual guide to […]

When it comes to putting together your pitch deck and preparing for an investor meeting,…

The GROW conference has brought dozens of high-profile VC's and super-angels to Vancouver which presents…

There are many great articles that outline what an entrepreneur should cover during a pitch, but very few discuss how to deliver that message in a compelling manner. That’s why I wrote, “A good story is the key to any pitch”, earlier this year.

I thought I’d revisit this topic with my visual guide to storytelling.

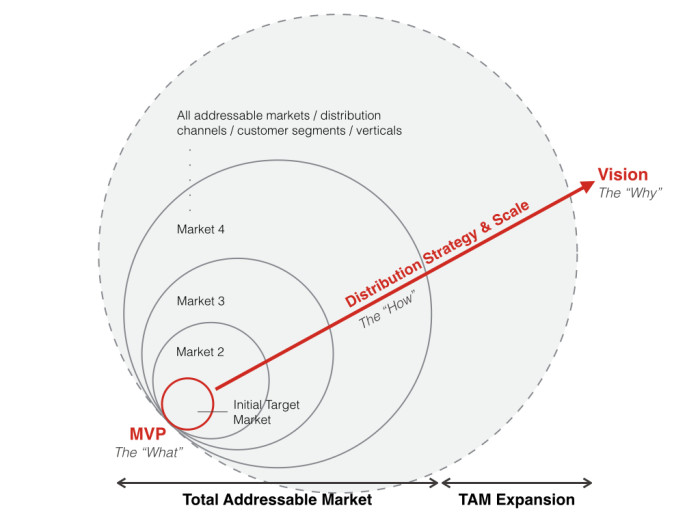

At nearly every meeting with an entrepreneur or fellow investor, I’m asked what we are looking for when we evaluate an investment opportunity. The obvious answer is a stellar team, but there’s more to it than that. Below, I’ve drawn how I map a typical checklist into a framework to help you better understand what we are listening for in a pitch.

**Note: I’m using the word ”market” or ”vertical” which applies to companies that can expand this way (i.e. Amazon, eBay, etc.). However, this diagram is still applicable for platforms where there is expansion from a niche audience (by demography, geography) to the masses, and for SaaS, expansion from an individual user or SMB to the enterprise.

Pitch your why, what, and how

Many entrepreneurs make the mistake of pitching to an investor in the same way they sell to a customer. Yes, we invest in companies that are solving a real pain point for the customer and it’s important for us to understand that pain point and how you help. However, we’re investing in the future in addition to what you’ve already built.

Sell the “what” as proof that you are onto something big, but always keep in mind that investors are buying into the “why.” There is no doubt that you have epic plans on how you are going to make it happen, now just let us know.

Crypto / Blockchain, Portfolio, Version One

We’re excited to announce our investment in Loon, a Canadian company building the country’s first regulated digital dollar. Version One led Loon’s $3M pre-seed round, alongside Garage Capital and a group of strategic Canadian angel investors. Loon is on a mission to create trusted, transparent payment infrastructure for Canada’s digital economy — starting with CADC, […]

As 2015 comes to an end, it’s time to reflect on what we’ve done and…

As the Internet evolves, the venture capital business starts evolving and we have been seeing…