2021 might be remembered as the year the world started to fully embrace the opportunity…

Version One

After more than 13 years of building Version One, 2025 was easily one of our wildest years—in the best possible way. We made nine new investments (our most in one year ever), spanning six different categories. We also distributed over $25M back to LPs across Funds II and III. And on top of all that, […]

2021 might be remembered as the year the world started to fully embrace the opportunity…

2020…the year of the pandemic. We’ve seen a tremendous amount of human loss and hardship,…

After more than 13 years of building Version One, 2025 was easily one of our wildest years—in the best possible way. We made nine new investments (our most in one year ever), spanning six different categories. We also distributed over $25M back to LPs across Funds II and III. And on top of all that, we raised two new funds (more on those in the new year).

Here’s a quick recap of what made 2025 so exciting:

New investments

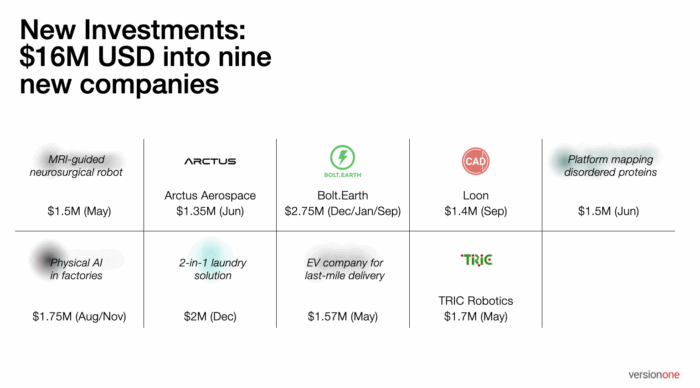

On the investment side, we invested $16M USD across nine new companies this year, covering robotics, drones, India, crypto, bio, and consumer hardware. The founders behind these companies are some of the most impressive we’ve ever met—true category creators. Their ambitions range from building a Canadian stablecoin (Loon), to mapping the behavior of disordered proteins (to be announced), to engineering drones that can reach 45,000 feet (Arctus Aerospace) and a neurosurgical robot capable of operating inside an MRI (to be announced).

And here’s a fun fact that says a lot about our current investment focus: eight out of the nine companies have a hardware component.

Liquidity

We also made meaningful progress on liquidity this year. Through activity in the crypto markets, we distributed over $9M from Fund II and $16M from Fund III, helped in large part by a relatively bullish crypto market. Regulatory sentiment has warmed—there’s broader acceptance of stablecoins, and the underlying infrastructure across the ecosystem is maturing. All of this created a window for us to return capital to our LPs.

New Funds

We also wrapped up something big on the fundraising front: two new funds closed at the end of June (we’ll share more details in the new year). We’re incredibly grateful for the support and confidence our LPs continue to place in us—and humbled that we were able to raise both funds in just six weeks! It means a lot that you believe in our strategy: same team, same fund size, and same thesis.

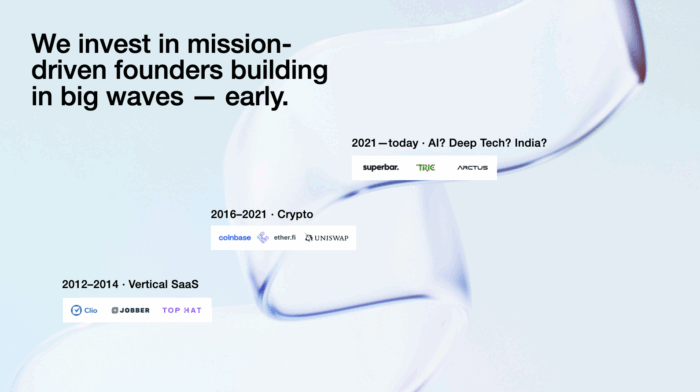

…And that thesis is about backing mission-driven founders who are building in big waves—early.

That often means investing before categories even exist. When we first started V1, we were early believers in companies like Clio, Jobber, and Top Hat—each of which went on to define its category in Vertical SaaS. In 2014, we started meeting Bitcoin entrepreneurs and backed crypto founders long before the space went mainstream (pre-ICO, pre-NFT). We got to invest in Coinbase, Uniswap, EtherFi, and many others.

These days, the waves we’re most focused on include: AI, Deep Tech, and India (stay tuned for an update on this shortly!)

But regardless of which waves we’re exploring, two core principles guide our strategy.

First, success as a generalist fund like ours requires continuously reinventing our networks and knowledge base to uncover the greatest alpha. As Peter Thiel puts it, we’re searching for 0 to 1, not 1 to n—those rare moments when something entirely new is being created.

Second, even with defined focus areas, we stay open to exceptional founders building outside these areas. You never know where the next breakthrough (or wave!) will come from, and some of our best investments have emerged from simply following extraordinary people.

All this to say: we’re incredibly excited for what 2026 will bring. With fresh capital, we’ll be able to support even more mission-driven founders who are building in big waves—early.

In the meantime, we wish our founders and all entrepreneurs (we are inspired by you and wouldn’t be here without you), our LPs, our community/network, and you and your loved ones a very happy holiday season.

Our best, always.

– Boris, Ange & Leah 🙂

PS: ICYMI, our friend Jordan Nel wrote a quick / fun read / case study on V1.

Portfolio, Version One

Last-mile delivery is one of those markets that looks simple at first glance—until you dig in and realize how much of it is held together by workarounds. As quick commerce scales across India, delivery volumes are exploding. Companies want to deliver more. But the vehicles powering those deliveries haven’t really kept up. Most are still […]

There’s a talent drain facing the tech industry today. We frequently hear about companies that…

We are very happy to announce our investment in Manifold, the easiest way to find…