Last week I blogged about the return multiples for our Fund I and how they…

Version One

We raised our first fund in summer 2012. It was a $15m early-stage fund that we invested in 20 portfolio companies over the course of two and a half years. We’re now seven years in and the portfolio is maturing. I plotted the return multiples (as of June 30, 2019) for all 20 portfolio companies […]

Last week I blogged about the return multiples for our Fund I and how they…

We’re thrilled to announce the closing of two new funds: Fund IV ($70M USD) and…

We raised our first fund in summer 2012. It was a $15m early-stage fund that we invested in 20 portfolio companies over the course of two and a half years. We’re now seven years in and the portfolio is maturing.

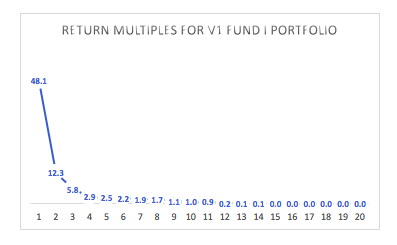

I plotted the return multiples (as of June 30, 2019) for all 20 portfolio companies in the chart below. The return multiple for a company is calculated by dividing the current net asset value (unrealized and realized dollar amounts) by the invested capital in that company (often invested over several rounds).

Looking at the chart, you can see that the best performing company in Fund I has generated over 48 times our invested capital to date, while a bunch of them did not generate any pay-back for the fund (and hence have a return multiple of 0). Of the 20 original portfolio companies in this fund, nine remain active while the other 11 were sold in a M&A process.

A few observations from these results:

A few observations from these results:

One of the great truths about early stage investments is that you have to be patient with them. The losses come early and the winners take longer to realize. It takes seven to ten years to get to real liquidity in a portfolio of early stage venture investments. You can’t short cut it. It just takes time. But come years seven, eight, nine, and ten the returns will start coming in.

Our numbers reflect what we already knew: startups are tough. Many fail and a few succeed. And those who succeed take a long time to develop. But there is no better job than working with our entrepreneurs every day to help them build a start-up that will become one of those outliers.

Portfolio

It’s been an eventful quarter (when has it not?), and somehow we’ve already crossed the halfway mark of 2025. We wanted to take a moment to highlight just a few of the wins, milestones, and momentum we’ve seen this past quarter. As always, there’s a whole lot happening behind the scenes that can’t be shared […]

The V1 family kicked off the new year with fresh energy and no shortage of…

At the end of Q1, we anticipated that a tech sector slowdown is ideal for…