Last week I blogged about the return multiples for our Fund I and how they…

Version One

We raised our first fund in summer 2012. It was a $15m early-stage fund that we invested in 20 portfolio companies over the course of two and a half years. We’re now seven years in and the portfolio is maturing. I plotted the return multiples (as of June 30, 2019) for all 20 portfolio companies […]

Last week I blogged about the return multiples for our Fund I and how they…

We’re thrilled to announce the closing of two new funds: Fund IV ($70M USD) and…

We raised our first fund in summer 2012. It was a $15m early-stage fund that we invested in 20 portfolio companies over the course of two and a half years. We’re now seven years in and the portfolio is maturing.

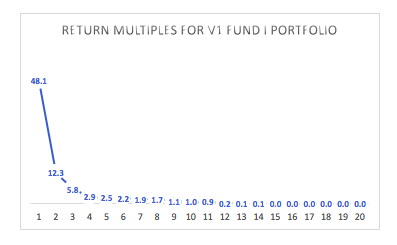

I plotted the return multiples (as of June 30, 2019) for all 20 portfolio companies in the chart below. The return multiple for a company is calculated by dividing the current net asset value (unrealized and realized dollar amounts) by the invested capital in that company (often invested over several rounds).

Looking at the chart, you can see that the best performing company in Fund I has generated over 48 times our invested capital to date, while a bunch of them did not generate any pay-back for the fund (and hence have a return multiple of 0). Of the 20 original portfolio companies in this fund, nine remain active while the other 11 were sold in a M&A process.

A few observations from these results:

A few observations from these results:

One of the great truths about early stage investments is that you have to be patient with them. The losses come early and the winners take longer to realize. It takes seven to ten years to get to real liquidity in a portfolio of early stage venture investments. You can’t short cut it. It just takes time. But come years seven, eight, nine, and ten the returns will start coming in.

Our numbers reflect what we already knew: startups are tough. Many fail and a few succeed. And those who succeed take a long time to develop. But there is no better job than working with our entrepreneurs every day to help them build a start-up that will become one of those outliers.

Version One

After more than 13 years of building Version One, 2025 was easily one of our wildest years—in the best possible way. We made nine new investments (our most in one year ever), spanning six different categories. We also distributed over $25M back to LPs across Funds II and III. And on top of all that, […]

2021 might be remembered as the year the world started to fully embrace the opportunity…

2020…the year of the pandemic. We’ve seen a tremendous amount of human loss and hardship,…