Last week, I shared some lessons learned from a Domino Data Science Pop-up that I attended a…

Data / AI / ML

Two months ago, I first introduced my vision to create a startup data repository. Since then, I’ve chatted with many of you who share the desire to democratize access to information on startups and bring transparency to what’s been a traditionally private ecosystem. I’ve been blown away by the response and appreciate every like, share, tweet, […]

Last week, I shared some lessons learned from a Domino Data Science Pop-up that I attended a…

I’m fascinated by the Open Data movement, particularly when it comes to government where the…

Two months ago, I first introduced my vision to create a startup data repository. Since then, I’ve chatted with many of you who share the desire to democratize access to information on startups and bring transparency to what’s been a traditionally private ecosystem.

I’ve been blown away by the response and appreciate every like, share, tweet, retweet, email, call, and coffee meeting. I’m thrilled that I underestimated the level of interest in this topic.

I also underestimated how ambitious this goal truly is. Through all these conversations, I’ve come to realize that not everyone has the same needs and expectations for startup data. Some of you want high-level KPI data (i.e. how “fast” is a fast-growing marketplace in terms of GMV). Others are looking for baseline information on operational expenses (i.e. what is a “reasonable” cost for square foot of office space in SF).

Today, I am seeking to define the scope of this project and would love your feedback.

Vision: A centralized hub of startup data

Mission: To provide answers to those questions that founders/operators frequently ask their investors and peers, and to replace anecdotes with data-supported answers.

Strategy: To crowdsource data, KPIs and benchmarks on anything from operations to sales to hiring.

What data is available today?

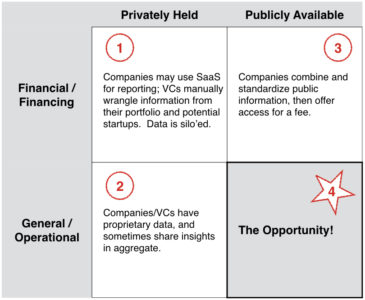

If we examine the current landscape of startup data, we can categorize it into two types: 1) financial statements and financing information; and 2) general/operations information (basically anything that’s not financial). And, we find privately held and publicly available information within each of these two categories.

The following figure breaks these categories into four quadrants: privately held financial, publicly available financial, privately held general and publicly available general.

1: Privately held financial

2: Privately held operational

3: Publicly available financial

4: Publicly available operational

The opportunity, what’s next and getting involved

After evaluating the current landscape, it’s clear that the lowest hanging fruit is in collecting general/operational data (#4). Ideally, we’d love for the repository to also shed light on financial statements and financing rounds – and perhaps in time we’ll be able to do so as we build trust and can demonstrate the value.

But for now, we’ll begin by crowdsourcing information through a series of anonymous surveys.

Are there any topics you’d like to learn more about? What questions do you have around operating costs? Are you curious about best practices in data science? What are the areas where you need more data to complement the anecdotes from founders and investors? Please leave your thoughts in the comments below.

There is so much more that we can do, so feel free to ping me with your feedback and suggestions for this project in general. And, if you’re interested in helping with this project, we’d very much appreciate it (we are a small team of two, after all!).

Until then… stay tuned for the first survey soon!

Version One

Over the past 13+ years, we’ve written a lot on this blog — investment announcements, portfolio recaps, year-in-reviews. But a handful of posts have captured something deeper: the ideas and convictions that actually guide how we invest. If you’re a founder trying to understand what makes us tick, or just curious about how our thinking […]

Two weeks ago, Boris recapped our fund and portfolio activity in what has been a…

In recent posts, we've outlined our updated thesis around backing mission driven founders and explained…