We know that companies are successful (or not successful) because of their people. Over the…

e-Books, Entrepreneurship

Over the past ten years, we have invested in and worked with close to 100 startups. Along the way, we have seen teams, ideas, and practices work spectacularly well. And, we’ve seen others that didn’t work out as expected. We decided to take the experiences and insights learned over the past decade and compile them […]

We know that companies are successful (or not successful) because of their people. Over the…

Two years ago, Danny Robinson, Maura Rodgers and myself started to lobby for a Startup…

Over the past ten years, we have invested in and worked with close to 100 startups. Along the way, we have seen teams, ideas, and practices work spectacularly well. And, we’ve seen others that didn’t work out as expected.

We decided to take the experiences and insights learned over the past decade and compile them in a short handbook on best practices for startups. Yes, we know…there are already many, many great books on the subject of startups.

We’re not trying to add more digital clutter. Instead, our handbook is focused on a particular stage of the startup lifecycle—post-Seed to pre-Series B. Since we primarily invest in seed stage companies with follow-ons to Series B, we are sharing some of the advice that we give our founding teams.

This handbook is broken into three sections: 1) Building your team; 2) Building your organization; and 3) Building your investor base.

You can download the handbook pdf here or check out the ePub version.

Our previous books – The Guide to Marketplaces and Understanding Social Platforms – have been well received, so we hope you’ll find this new book useful for your own startup journey.

Please keep in mind that this handbook is:

Finally, we wish to thank Andrew Sider, Sam Pillar and Alex Kern for their invaluable feedback during the creation of this book.

Happy reading! And happy (US) Thanksgiving!

-ange & boris 🙂

Table of Contents

Do you want to create a startup? Are you in the midst of building one?

Over the past ten years, we have invested in and worked with close to 100 startups. Along the way, we have seen teams, ideas, and practices work spectacularly well. We’ve also witnessed others flame or fizzle out. After a decade in the trenches, we want to share some best practices to help you make an impact and turn your vision into reality.

You might be thinking, “Aren’t there already a lot of startup guides out there?” It’s not our intention to add more digital clutter to a crowded landscape. In this guide, we’re focusing on a particular stage of the startup lifecycle—post-Seed to pre-Series B. Since we primarily invest in seed stage companies with follow-ons to Series B, we’re going to share some of the advice that we give our founding teams.

For this reason, we won’t focus on the logistics of company formation here. Likewise, you won’t find any content on product-market-fit (PMF), although we recognize that PMF isn’t always reached at the seed stage. If you’re looking for help on this stage, we strongly recommend Sam Altman’s Startup Playbook.

You also won’t find much content for Series B and beyond. For help scaling, we recommend Elad Gil’s High Growth Handbook.

This guide is broken into three sections:

We want to thank Andrew Sider, Sam Pillar, and Alex Kern for their invaluable feedback during the creation of this book. It’s intended to be a living document and will be regularly updated by our team, with help from our wise community. There’s nothing more valuable than the insight that comes from real-world experiences, so we welcome you to share any thoughts, lessons, and experiences.

We hope you’ll find the content useful for your own journey. Keep in mind that while this guide is built around best practices and real world experiences, it doesn’t mean that everything will fit your specific startup and situation. You may want to add your own twist to some practices or ignore some advice altogether. As you’re building your business, never forget that you’re in charge. It’s up to you to decide the best way to run it.

We often hear from founders that hiring is the most challenging thing to do right. It’s also the most important. Hiring forms the foundation of your company. Good hires, which result from a strong hiring process, will have an outsized effect on your startup’s success.

In this chapter, we’ll cover all the essentials of building your team—from growing your candidate pipeline to cultivating your culture and building distributed teams. Many of you will be interviewing and hiring during the early stages. And, hopefully those hires will result in a better company than you have today.

Reminder: Since this book is focused on a startup’s early days, our hiring advice is primarily geared toward your first 10 to 20 hires. If you’re beyond this stage and looking to scale your recruiting function, we again recommend Elad Gil’s High Growth Handbook.

Everyone appreciates the importance of hiring. The challenge lies in translating this appreciation into action. When a startup is scaling rapidly, process often gets left behind. In our experience, successful hiring is a combination of process discipline and a proper system of checks and balances.

We break down the hiring process into four basic steps:

Recommended reading: Kevin Morrill, co-founder of our former portfolio company Mattermark, recently published the Interview Game Plan Template with very helpful checklists, process ideas, and scripts.

Step One: Understand your need (define the candidate profile)

Before you start hiring, you should understand who you need. What will the person do? What are the ideal backgrounds and qualities for the job?

Generally speaking, you are trying to hire athletes (i.e. high-performing generalists), not specialists, during early-stage hiring. You should prioritize for smarts, work ethic, and ambition over experience. First hires should be like “swiss army knives,” willing to take on multiple tasks at any stage and able to figure out their own solutions. With that said, there are certain situations where specialists will be key for early-stage companies—it’s usually specialists, not generalists, who push toward more ambitious, visionary problem solving.

When it’s time to start hiring specialists, you will need to be very specific with the job description. For example, let’s say you want to hire your first marketing person. You might need a demand generation marketing rock star. Or, maybe you need someone who is really good at product marketing and developing solutions for customer needs. Clearly, these two marketing roles require different backgrounds.

The bottom line: take the time to develop the ideal profile of a position, so you can better target your search and interview process.

Step Two: Build your pipeline

Throughout a startup’s lifecycle, the recruiting function should evolve from DIY recruiting (seed stage) to hiring a recruiter or Head of People. No matter your stage or size, never wait for candidates to come to you; you need to actively build a pipeline.

Early-stage recruiting

During the early stages, we wouldn’t expect a startup to have a dedicated recruiting position, but there’s still plenty you can do to build your pipeline and find the right candidates.

Hire a recruiter and/or Head of People

We recommend that companies build up their in-house recruiting function as soon as they’re ready to hire at scale. This is usually after the A round, although we recognize that different companies are ready to scale at different stages.

Jeff Richards makes a strong case for hiring an internal recruiter or Head of People early: “If you really believe people are going to differentiate your ability to win, then why wouldn’t you invest in an expert in this area early—just as you are in Engineering, Sales, Marketing, etc.?”

One caveat: when candidates are looking to join a company during the early stages (i.e. under 10 employees), they are most likely looking to build a relationship with a founder. In this case, founder-led recruiting (or at least founder-led outreach) can be most effective.

You might be wondering if you need to hire a Head of People or recruiter. These two positions are quite different. A recruiter typically has one specific function: sourcing candidates. A Head of People, typically brought in at around 50+ people, is responsible for setting up an organization to do their best work in a way that scales. Someone hired as a Head of People likely won’t want to do recruiting. Or if they do, it won’t be their primary focus.

When you need to quickly go from 25 to 50 employees, your biggest issue is typically recruiting—and you may not have the budget to hire a Head of People. At this stage, bring someone onboard who is great at recruiting.

After your headcount hits 50, it’s time to look beyond just the recruiting function and hire a Head of People. Chelsea MacDonald, Head of People Operations at Ada Support, considers this a renaissance role. “You’re looking for skills in: marketing & PR (employee branding, communications, events), BDR and sales (recruiting), product (employee experience, diversity, data), customer success (employee performance), and legal (HR law, terminations). Throw in a bit of wellness coach, and you have yourself a role for a renaissance person (or alternatively, someone who knows how to hire for their weaknesses).” You can learn more about Chelsea’s thoughts on the Head of People role.

Engage an external recruiter

While internal recruiters should do the bulk of the pipeline work, it makes sense to leverage external recruiters for VP-level positions and up. External recruiters are very expensive, but are usually a worthwhile investment for key hires. As we’ve mentioned before, we recommend Elad Gil’s High Growth Handbook for tips on scaling your recruiting function.

Step Three: The interview process

It’s always astonishing to see how many good companies are unprepared for the interview process. You’ll probably recognize many of these missteps: interviewers show up late for meetings and haven’t been briefed on the candidate beforehand. They spend the first few minutes of the interview fumbling through the CV, asking vague questions to gain context. Then after each interview, they don’t properly collect feedback.

Whether you’re trying to grow from 10 to 25 employees, or from 25 to 50 employees, hiring is one of the most important functions in your company. This is why we encourage every founder to take the time to define a proper interview protocol that works for both the company and candidate. You’ll want to document the process and be sure to explicitly assign each task (recruiting, interview day, hiring decision, etc.) to an individual. Particularly during the early stages, it’s all too easy for certain tasks to fall between the cracks when there’s no specific ownership assigned.

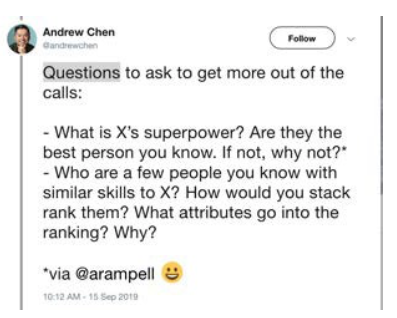

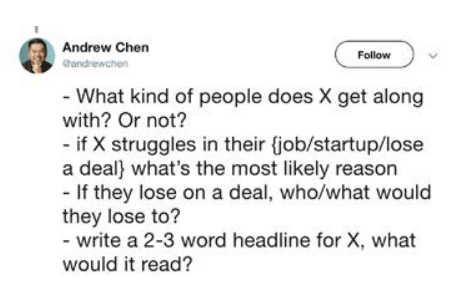

A16’s Andrew Chen also suggests some great questions to get more out of your reference calls:

Lastly, if possible, try to get backdoor references for the most honest feedback. These are people that you trust and know the candidate, but weren’t given as a reference by the candidate. The easiest way to find backdoor references is to look for mutual connections on LinkedIn.

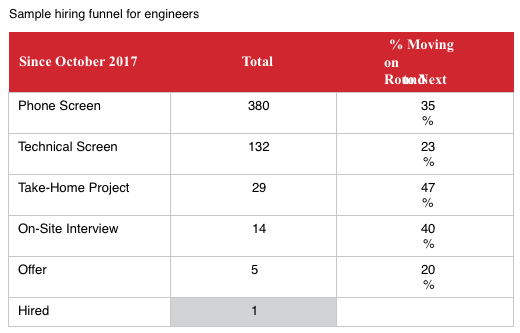

Step Four: Close the candidate

Once you decide to hire a candidate, try to do everything to close the deal. One of our portfolio companies shared its hiring funnel for engineers. Their key finding: only 20% of candidates accepted an offer. We wouldn’t be surprised if most startup funnels had a similar number. The question is: what can you do to improve the acceptance rate?

Founders need to be the ones closing candidates early on, but investors and board members can also help. Recommend that a candidate speak to one of your investors. Reassure the candidate that the investor will not be evaluating his or her skill, but rather, is available to answer any questions and address any concerns around you as a founder, the company, the market, and the competitive landscape.

As for selecting an investor for this task, you obviously want a champion but also someone who has a good pulse on your business and your team, and not just a 35,000 ft. view. A good “closing” investor is one who knows the competition, sees the current challenges of your startup, and more importantly, has a strong conviction about the opportunities ahead. He or she can effectively pitch candidates on the impact they can make to align with the big opportunities ahead.

Boom is one of the most ambitious startups we know—their mission is to develop supersonic planes. As you can imagine, you need incredibly talented people to achieve this goal. So when Blake Scholl, Boom’s founder and CEO, recently shared insights into the company’s hiring playbook in an investor update, we asked him for permission to publish. The “Boom Way of Hiring” is a great blueprint for startups to take their recruiting processes to the next level. As you’ll see at the end, their acceptance rate is nearly 100%.

The following insight is an extract from Boom’s investor update:

We like to say that our vision is to remove the barriers to experiencing the planet, but our mission is actually about company building: we aim to make Boom the place where the best people on the planet can be inspired and enabled to do the best and most meaningful work of their careers. If we succeed at our company- building mission, we’ll realize our vision. But if we screw up the team, culture, or management structure we most certainly won’t.

Recruiting is at the heart of what we do, and it’s everyone’s job.

This month was epic for recruiting. We extended 18 offers, of which 14 were accepted, 3 are still pending and only one intern declined*. Including accepted offers from folks not yet started, Boom is now 96 strong—and we expect to be over 100 by the end of the year. We did this with a dedicated recruiting staff of one (!), which is both a testament to how hard Tim (recruiter) is cranking as well as the dedication of our hiring managers, who take direct responsibility for filling their roles.

I’d like to highlight one of those hires: Chris “Duff” Guarente, who is joining as our second test pilot, behind Bill “Doc” Shoemaker, our Chief Test Pilot. Duff comes to us from Scaled Composites where he was Chief Test Pilot and has a deep background in flight test of new-design aircraft. Duff flew 100% of missions on Northrop’s T-X “Swift” and was the first test pilot to fire AIM9X guided missiles from the F-22 Raptor.

In other words, we hired the #1 pilot from the #1 experimental aircraft company in the world… to be the #2 pilot at Boom. Since the founding of the company, we’ve said that we should be able to raise the talent bar as we go. How’s that? In part, our access to talent improves over time: The number one thing great people want is to work with other great people—and the more we attract, the more want to be here. Additionally, as our success becomes more visible, more people are willing to make the leap to a startup—broadening our access to talent.

Success in recruiting requires process discipline and checks and balances as well. We’ve learned from Amazon, SpaceX, and Google and developed a Boom Way of hiring. Here are some of the pillars:

Lastly, we have a Founder interview as the last check before a candidate gets an offer, after the interview team has decided to move forward. Historically, that’s been with me—now we’re transitioning to have my co-founders Josh and Joe do Founder interviews as well. The Founder interview is a QA check on the whole process—we read the interview notes, look for yellow flags and check whether they were addressed in the debrief. We check culture fit and look for key characteristics, like a history of being curious and being a self-starter. Additionally, the Founder interview is a pre-close: we ask: “assuming the numbers work, what are the barriers to accepting an offer?” and then sell until we’ve overcome all the non-financial objections. Importantly, we help frame the candidate’s decision process and work to focus them on making a decision based on fundamental characteristics that will truly matter to their happiness: do you believe in the mission? Do you believe you’ll be able to contribute meaningfully? Do you like and respect the people you’re working for and with? We remind candidates: “You have to love the vision. It’s really hard—and there are going to be ups and downs. If you don’t love it—and you’re sane—you’re going to give up.”

The result is both a high offer acceptance rate (near 100%) as well as a low regretted attrition rate (2 cases of regretted attrition over 4 years across ~100 hires).

Source: Blake Scholl, Boom investor letter

Your hiring brand has a big impact on each step of the hiring process and will ultimately shape how successful you are in attracting and converting candidates. Here are a few tips on developing your hiring brand:

Your company’s culture is not about perks and ping-pong tables. It’s about common values and a shared passion for why the company exists. It’s also about how everyone can work together to pursue your common goals.

Here’s Shopify’s definition of culture:

“We define culture as the sum of every single individual at Shopify. Every person plays a part in creating it, and when someone leaves or joins, they have a direct impact on the culture.”

Culture is created by the people that you hire. This means that the way you set up your hiring process has a huge impact on the culture you are creating.

Set clear values and live them. Practically every start-up has created a list of values that they care about, but not every startup actually lives them. The consistency of your daily actions as a leader and as an organization will make sure that your team remembers the values, believes in them, and lives them. If you talk about a “no politics” rule, but then promote a person who is viewed as being overly political, your words just lost all credibility. The founder and CEO needs to lead by example.

On diversity and inclusion

There are countless studies showing that diverse teams are more successful. Josh Brewer, CEO/Founder of Abstract (a V1 portfolio company) wrote a great post on the topic of how inclusion is a choice. It’s recommended reading for all.

Josh writes:

“…we began recruiting people from underrepresented backgrounds. We brought in people—from all backgrounds—who are genuinely passionate about inclusion. We built a remote-friendly culture that allowed us to include people from across the United States. We threw out the engineering white board interviews (that don’t work anyway) and began to bring in diverse talent in every one of our departments.”

The predominant advice for startups has traditionally been don’t open a second office until you reach 100+ employees. However, the pressure of sky-high housing costs, salaries, and competition for suitable candidates is causing startups and investors to rethink their approach to distributed teams. Among our Silicon Valley-based portfolio companies, every company past Series A has a distributed team.

In addition to cost concerns, your company’s location will also be driven by the location of the specific talent you are looking for, as well as the location of your key customers.

When it comes to opening a second location, there are two common approaches:

Companies with distributed teams need to work harder to create a tight culture absent of regular offline interactions. Bringing everyone together in person on a regular basis and using online tools like Donut can help in this regard.

Compensation typically includes both cash compensation and equity (options). During the early stages of a startup, cash compensation is less of a factor. Early employees usually join for reasons other than their take-home salary. They may be looking for a significant equity stake, truly believe in the vision of the company, or probably both.

As a startup matures, cash compensation becomes more important and, as a founder, you need to understand how your company’s compensation fits into the overall landscape of what comparable startups are paying. This is where compensation surveys come into play.

There are many public and private compensation surveys available, but the best free data is available from AngelList and PayScale:

Other surveys include: Hired (for tech roles), Betts Recruiting (for sales, marketing, and ops roles), and LTSE’s Hiringplan.

About equity

Equity is usually given to employees as option grants. Here are some common rules for option programs:

Recommended reading: “A No B.S. Guide to Startup Stock Option Grants.” SkillShare’s Matt Cooper sheds light on how they determine the size of option grants and how potential and current employees can evaluate their option value—including links to calculators that companies can use for new hires.

Rapid growth is the defining element of a startup. It’s also the thing that makes scaling startups incredibly hard. Many founders are first-time entrepreneurs and find themselves needing to scale an organization without having seen or done anything like it before. Employees that joined as individual contributors are often asked to become managers before they’ve acquired that skill set. And an organization that was run by a small group of aligned people during the first few years now has to think about org charts, scalable processes, budgets, and Objectives and Key Results (OKRs).

In this context, it is critical to invest in yourself and your people.

Invest in yourself

Great leaders are made, not born—although we tend to see just the end result and not the hard work that led to the success. Scaling from founder to manager is going to take a whole village— coaches, mentors, peers, feedback from your company and direct reports. Most importantly, you need to look at feedback as an opportunity to grow, rather than as criticism.

We can all learn from what Stewart Butterfield has done, and continues to do, at Slack. In conversations with Stewart, we are always impressed by how self-aware he is about his own strengths and weaknesses. He actively seeks feedback on how he can further improve himself. This has been critical because when a company scales as quickly as Slack scaled, its leaders need to scale equally fast.

We cannot emphasize enough the importance of growing as a leader. When founders fail to level up as a manager, or can’t recognize their own limitations to build an executive team around those areas of weakness, the startup often fails (usually somewhere between 25 and 75 employees). Sometimes, the CEO is removed by the board, but this action is often too little, too late to save the company.

With that in mind, here are some of the resources you can use to help you grow as a leader:

Invest in your people

Leadership development is typically limited to executives, but employees at all levels can benefit from some kind of coaching—particularly those who are promoted to first-time management positions.

Newer generations of employees recognize coaching and development as an important employee benefit—like health benefits or retirement savings matching. For some, employee development is a table stakes responsibility of the company. As Jobber CEO Sam Pillar explained, “Coaching and development is a significant competitive advantage for talent.

Since this aligns nicely with the imperative for the company to get the most out of its people, I think it’s a no-brainer for companies to invest here.”

Shopify has done a great job in making sure their company leaders are nurtured and developed at all levels of the organization. They brought on a part-time coach when the company had around 60 employees, and then a full-time coach when they reached 160 employees. They’ve been offering one-on-one coaching for executives, ad hoc mentoring for first-level managers (who supervise employees directly) and second-level managers (who manage supervisors), as well as “at scale” leadership workshops for all company managers.

You don’t have to bring the coaching function in house. LifeLabs Learning offers a good series of workshops and some of our portfolio companies have used Sounding Board and Prosper for scalable and affordable 1:1 coaching.

Preventing marginalization as you scale

People often talk about the challenges associated with moving from individual contributor to a leadership role. But we’ve noticed another challenge that isn’t as frequently discussed: early employees who are generalists can feel marginalized out of their responsibilities as the company matures and roles begin to narrow in focus.

To keep these early generalists motivated, invest in their depth. Start developing specific “technical” skills in engineering, product, marketing, sales, and design—wherever an employee shows interest and aptitude. Having a VP/Head of People in your organization is a great way

to address this issue, since you have someone who is dedicated to thinking about your people and their growth.

As Ada’s Head of People Chelsea MacDonald explained to us, “The question that keeps me up at night is: ‘Is everyone at Ada working on the most important things, at the edge of their abilities?’… I still worry about [getting sued], but the cost of a lawsuit is drastically less than the cost of our entire team working on the wrong things, or not working to the best of their abilities.”

We’ve also seen marginalization become an issue for co-founders who are not CEOs. As the company grows, it may turn out that the technical co-founder isn’t right for a CTO or CPO role. Now what? If keeping the co-founding team is important, you need to find ways to keep the non-CEO co-founder engaged. You can make them responsible for running special initiatives or projects. He or she knows the long-term vision of the company and can help give the company a head start on that path.

Operations are very ad hoc when you’re a small team working hard to get to product-market-fit. Once you start scaling, people may no longer be as aligned. Decisions aren’t made as quickly.

And, the whole pace of execution starts to slow down. The problem is you’re still a startup— being an aggressive and fast-moving entity is usually the only fighting chance you have against incumbents.

Amazon’s magic is that it’s a behemoth of a company that still operates like a founder-driven startup in several key areas. This is partly because Bezos has a strong cultural influence throughout the company. But, he also developed some unique tools to institutionalize his core values in the company.

Here are a few best practices that can keep a startup executing fast while scaling up the size of the organization:

I will (Objective) as measured by (this set of Key Results).

If you want to know more about the OKR system, there are numerous books on the topic, with the most recent being Doerr’s Measure What Matters.

Running a successful business means that you have to know when you are actually successful, not just in a qualitative way, but in a quantitative way. This requires that you come up with a set of metrics or KPIs that best reflect your company’s health.

Start collecting data on your product, sales funnel, etc. as soon as you can. There are many tools to help you do this, such as Mixpanel, Amplitude, Heap, and Salesforce.

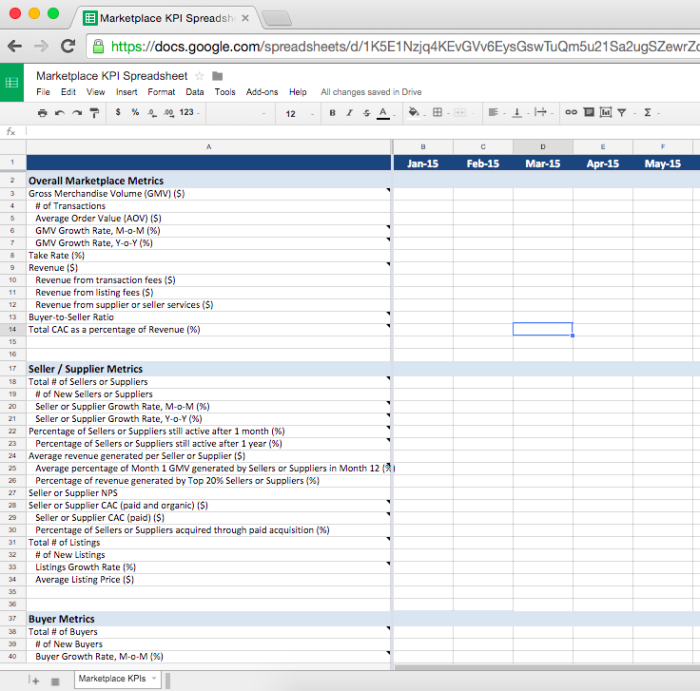

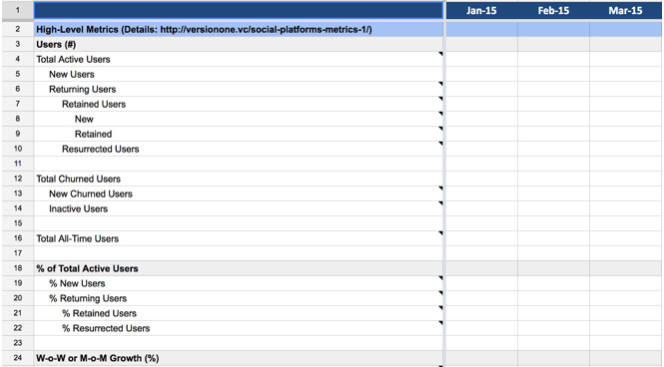

We recognize that every startup is different and different business models have different indicators of success. There’s no one-size-fits-all metric when it comes to quantifying your startup’s health. With that said, we’ve put together KPI dashboards for marketplaces and social networks. You can access our KPI templates via Google Docs (links provided on the following pages). Make a copy of the one you need and then you can edit away to customize it for your business.

Marketplace metrics

Access our marketplace KPI dashboard on Google Docs here.

Social platform metrics

Access our social platform KPI dashboard on Google Docs here.

SaaS metrics and cohort analyses

For SaaS startups, we recommend Mamoon Hamid’s “Numbers that Actually Matter: Finding your North Star.”

For cohort analyses for early-stage startups, we recommend Christoph Janz’ spreadsheet.

Early stage benchmarking

It’s imperative to understand the dynamics of your business—which knobs you can turn and which levers you can pull to really grow your company. When it comes time to raise your next round, future investors will want to know how the infusion of capital will help you scale. To this extent, you should be able to differentiate between vanity and actionable metrics.

Internally, having a metrics dashboard and a North Star metric will help align the entire organization around a common goal. And these metrics should be connected to your OKRs as we discussed in the previous section.

Metrics can also give you an opportunity to benchmark yourself against others so you know what your milestones should be. Point Nine Capital put together a helpful chart linking important milestones and fundraising stages for SaaS companies. And we collaborated with them to create a similar framework for marketplace startups, which you can access as a Google Sheet or in stylized marketplace napkin form. Point Nine updated the marketplace napkin for 2018 (note that the currency is in Euros).

For additional resources:

Keep in mind that metrics are only as good as the underlying infrastructure for collecting and processing data. This can be challenging in the early stages, as your ecosystem of tools and processes are quickly evolving. The way you measure something can change over time. For example, one of our portfolio CEOs reported a net negative churn for about six months. As it turns out, the churn was not negative; there was an error in how they pulled a particular metric out of one of their systems. The bottom line is that good metrics require an ongoing investment and focus on the underlying data infrastructure.

We love data-driven startups. Data gives you the capacity to improve your product (through personalization, recommendations, etc.), which leads to greater data network effects and greater defensibility over time.

Fundraising is a big part of every startup. Like it or not, you’ll have to get really good at it.

Our first piece of advice: only raise when you’re ready. Our definition of “ready” is when you have achieved the milestones that you set out for this fundraise and you have all your ducks in a row (e.g., a deck and data room, if applicable).

We are not going to cover “how to pitch,” as there are countless good resources on the topic already. Instead, we’ll focus on the process so you’re better prepared on what to expect during your fundraising journey.

When you’re fundraising for the next round, you want to leverage your current investors. Here’s how:

If you find yourself in the fortunate position of being oversubscribed, you’ll need to figure out who you should have in your cap table and who will be the best partner for your journey. As a founder, you have control of allocation and it’s in your best interest to fill your round with people who are valuable to you. If your lead investor wants the full round, you do have several levers to pull to bring others in the round if you’d like.

Here are some considerations for choosing your investors:

A growing number of companies are raising bridge rounds in order to extend their runway. It’s a tempting offer (who doesn’t want easy money?) and can work for certain situations. We think a bridge round can be smart when you’ve reached your milestones, but want to build an even stronger case for your next round. In this situation, it’s common for existing investors to put together an internal round, as they preempt their pro rata.

However, bridge notes can be problematic at times. Be wary of using a bridge round when you fall short of your original milestones. Some investors may see this as an inefficient use of capital. If you do decide to take a bridge round in this situation, make sure you have a strong narrative to counter any concerns.

Be aware that bridges usually take the form of a note that converts in the subsequent round. You need to understand how this will affect your cap table. Taking a note in between rounds can make it hard to create enough allocation in the next round to attract a high quality lead. Fred Wilson has written several good posts on the pitfalls of convertible and SAFE notes: Convertible and SAFE Notes and Raising a SAFE or Convertible Note in Between Rounds.

After fundraising, there might be other sources of non-dilutive capital that you can use to extend your startup’s runway. Venture debts are loans that are tailored to fast-growth startups (defined as companies that have raised money from venture capital firms or other institutional sources). You can learn more about venture debt fromSilicon Valley Bank.

Venture debt can be helpful to get the capital you need to grow without adding to dilution. To consider venture debt, you should have found product-market-fit and are in a growth phase. Venture debt can be useful to fund the purchase of equipment, inventory, or advertising to spur additional growth. In other words, venture debt is a short term financing instrument—it should not be considered a way to extend the runway.

Don’t raise money through venture debt if you don’t already have access to capital. According to Fred Wilson writes: “I encourage our portfolio companies to take the Venture Debt markets all the time once they have become credit worthy on their own. It is smart to use debt vs. equity when you can absolutely pay the debt back.” On the flipside, he also advised, “financing companies with debt when the company has no obvious means other than their VC investors to pay the loan back is bad financial management.”

Venture debt can be problematic in later equity rounds. If you enter an equity round with venture debt, the new investors will have to agree to either repay the debt or invest below the debt in order of preference. If you’re interested in learning more about when to use (and when not to use) venture debt, we recommend Howard Marks’ article, What to Know Before Going into Venture Debt.

After the fundraising is over, it’s critical to build a strong communication channel with your investors. Most investors are not just looking to write a check and go away. The more engaged your investors are in your startup, the stronger and more beneficial the relationship can be. Keep your investors up to date and they can better identify opportunities to help you. Keep your investors engaged and they’ll be more effective cheerleaders for your company.

If you communicate well in the good times, you will create the trust and alignment that’s essential to navigate the bad times.

Monthly reports

You can’t go wrong with formal communications like written monthly reports. These can be short, but should contain three things:

Andrew Sider, a former portfolio CEO (VarageSale) and current investor, summed up his advice for these monthly updates: “A common trap is to make these updates too long and fluffy (everything is amazing!). I prefer a quick metrics recap, small story narrative update, and your asks of the group. But realistically, you don’t get many responses to these emails (ever). You’re better off making asks in 1-on-1 emails outside of these update emails.”

Monthly communication example: ADA

The following is an example of a monthly email, from Ada’s Mike Murchison:

Hi team,

We recently launched our new website, closed our debt facility, and have been pushing our [xxx] deal along.

We’re now shifting our focus towards Series A fundraise. I’m planning on being in the Bay Area Sept 26 – Oct 6.

Please see more detailed update below, and looking forward to catching up tonight. Mike

Product

Sales

Revenue

Efficiency

Pipeline: [$x.xM]

New Accounts

Finances

Closed [$x.xM] venture debt facility from SVB

Fundraise

Team

FTE: [xx]

Recently hired

Hiring: [xx] FTE by early Q4

Help

Most boards meet on a quarterly basis, but we’ve seen companies ramp up this cadence (typically meeting every 6-8 weeks) during crucial periods. Many companies also schedule monthly board calls in between the quarterly meetings and this is an efficient way to keep everybody informed.

It goes without saying that the quality of a board meeting can have a big impact on the value that the board brings to your company. With proper preparation, board meetings can be useful and productive sessions. But meetings that are poorly organized, go on too long, and stray off on tangents can weaken the commitment of your biggest supporters.

During pre-seed and seed stages, we recommend getting into the practice of having quarterly board meetings. They can be informal (legal representation or official minutes aren’t required), but still follow the general structure and tips outlined below to make the best use of everyone’s time.

Here are our best practice tips for successful board meetings:

We hope that your investor is an enthusiastic and steady supporter of both you and your startup. Starting, building, and scaling a company is challenging enough; you don’t need your investors to add drama to the mix. So, assuming you have (or will have) great investors on your side, what are the best ways to leverage them?

And lastly, your ability to leverage your investor depends on the strength of the relationship. A great relationship typically starts with regular and open communication. If you haven’t read it already, go back in this chapter and see our section on investor communication.

Advisors can be instrumental in providing additional knowledge and connections, but you should be aware of some potential pitfalls when bringing advisors on board. There are too many people out there who love to be associated with startups. They want the financial upside, but never deliver as expected.

Here’s our advice for working with advisors:

Introduction

Altman, Sam. Startup Playbook. https://playbook.samaltman.com

Gil, Elad. High Growth Handbook Scaling Startup from 10 to 10,000 People. Stripe Press, 2018.

Chapter 1

Gil, Elad. High Growth Handbook Scaling Startup from 10 to 10,000 People. Stripe Press, 2018.

Morrill, Kevin. Example: Interview Game Plan. https://docs.google.com/document/d/1NFDIGw0Gww67NXe5rr83lJHB8VW1l1QD90exTeL_ulE/edit#

Richards, Jeff. The People Conundrum. LinkedIn, June 8, 2017. https://www.linkedin.com/pulse/people-conundrum-jeff-richards/

Tran, Angela. What does a Head of People do? Learning from Ada’s Chelsea Macdonald.

Version One Blog, May 23, 2019. https://versionone.vc/chelsea-ada-headofpeople/

Thawar, Farhan. Technical Interviews are Garbage. Here’s what we do instead. Medium, October 20, 2017. https://medium.com/helpful-com/https-medium-com-fnthawar-helpful-technical-interviews-are-garbage-dc5d9aee5acd

Bensinger, Greg. Amazon’s Current Employees Raise the Bar for New Hires. The Wall Street Journal. January 7, 2014. https://www.wsj.com/articles/amazon8217s-current-employees-raise-the-bar-for-new-hires-1389124745

Tran, Angela. The importance of consistent messaging. Version One Blog, November 17, 2014. https://versionone.vc/consistent-messaging/

Brewer, Josh. Inclusion is a Choice. Inside Abstract. https://www.goabstract.com/blog/inclusion-is-a-choice

Cooper, Matt. A No B.S. Guide to Startup Stock Option Grants. Medium, July 31, 2019. https://medium.com/swlh/a-no-b-s-guide-to-startup-stock-option-grants-526a8bc33c2b

Chapter 2

Wertz, Boris. Three leadership lessons from Slack’s Stewart Butterfield. Version One Blog, August 8, 2018. https://versionone.vc/three-leadership-lessons-from-slacks-stewart-butterfield/

Weinberg, Cory. The Coaches Behind Startup Founders. The Information, March 20, 2018. https://www.theinformation.com/articles/the-coaches-behind-startup-founders

Schmidt, Eric, Jonathan Rosenberg, Alan Eagle. Trillion Dollar Coach: The Leadership Playbook of Silicon Valley’s Bill Campbell. HarperBusiness, April 16, 2019.

Wertz, Boris. Shopify’s big people investment: how a startup scaled coaching beyond its executives. Version One Blog, December 7, 2015. https://versionone.vc/shopifys-big-people-investment-how-a-startup-scaled-coaching-beyond-its-executives/

Wilson, Fred. The Heartbeat. AVC.com, June 27, 2018. https://avc.com/2018/06/the-heartbeat/

Rosoff, Matt. Jeff Bezos: There are two types of decisions to make, and don’t confuse them. The Business Insider, April 5, 2016. https://www.businessinsider.com/jeff-bezos-on-type-1-and-type-2-decisions-2016-4

Deutschman, Alan. Inside the Mind of Jeff Bezos. Fast Company, August 1, 2004. https://www.fastcompany.com/50106/inside-mind-jeff-bezos-5

Doerr, John. Measure What Matters. Portfolio, April 2018.

Hamid, Mamoon. Numbers that Actually Matter. SlideShare, February 9, 2017. https://www.slideshare.net/03133938319/numbers-that-actually-matter-finding-your-north-star

Janz, Christoph. Point Nine Capital Cohort Analysis Spreadsheet. @AndrewChen. https://andrewchen.co/the-easiest-spreadsheet-for-churn-mrr-and-cohort-analysis-guest-post/

Morrongiello, Julia. The Markeplace Funding Napking 2018. Medium, November 27, 2018. https://medium.com/point-nine-news/the-marketplace-funding-napkin-2018-847d775a0a55

Janz, Christoph. What does it take to raise capital, in SaaS, in 2016? The Angel VC, May 31, 2016. http://christophjanz.blogspot.com/2016/05/what-does-it-take-to-raise-capital-in.html

Tunguz, Tomasz. Series A SaaS Startup Benchmarks for 2018. TomTunguz.com, January 4, 2018. https://tomtunguz.com/series-a-saas-startup-benchmarks-for-2018/

Chapter 3

Wilson, Fred. Convertible and SAFE Notes. AVC.com, March 2017. https://avc.com/2017/03/convertible-and-safe-notes/

Wilson, Fred. Raising a SAFE or convertible note in between rounds. AVC.com, February 2019. https://avc.com/2019/02/raising-a-safe-or-convertible-note-in-between-rounds/

Wilson, Fred. Financing Options: Venture Debt. AVC.com, July 2011. https://avc.com/2011/07/financings-options-venture-debt/

Marks, Howard. What to Know Before Going into Venture Debt. Forbes, May 13, 2018. https://www.forbes.com/sites/howardmarks/2018/05/13/what-to-know-before-going-into-venture-debt/#4a60664578b2

Wilson, Fred. Executive Sessions and Continuous Feedback. AVC.com, January 2019. https://avc.com/2019/01/executive-sessions-and-continuous-feedback

Collin, Mathilde. What it’s like working in Sequoia. Medium, April 3, 2018. https://medium.com/@collinmathilde/what-its-like-working-with-sequoia-2a46ebdb069

Crypto / Blockchain, Portfolio, Version One

We’re excited to announce our investment in Loon, a Canadian company building the country’s first regulated digital dollar. Version One led Loon’s $3M pre-seed round, alongside Garage Capital and a group of strategic Canadian angel investors. Loon is on a mission to create trusted, transparent payment infrastructure for Canada’s digital economy — starting with CADC, […]

As 2015 comes to an end, it’s time to reflect on what we’ve done and…

As the Internet evolves, the venture capital business starts evolving and we have been seeing…