Coinbase

Crypto / BlockchainToday our portfolio company Coinbase went public via a direct listing. With an initial market cap of over $100b, it is one of the most valuable public listings of all times in the US. It is also the first IPO in the Version One family and hence, a special milestone for us as a fund.

We got to invest into Coinbase when we joined their Series D in fall of 2017. It was a much later stage for us than our typical pre-seed/seed investment. At Version One, we believe that we are best when we stay in our early-stage lane, but in this case, we felt very confident that we should make an exception to our investment focus. We laid out our thesis for the Coinbase investment around 3 points:

- As early as late 2016, we believed that blockchain/crypto would be the next computing platform and we had made several investments against that thesis already. Having a thesis (and a few investments against it) made it easier to evaluate an exception.

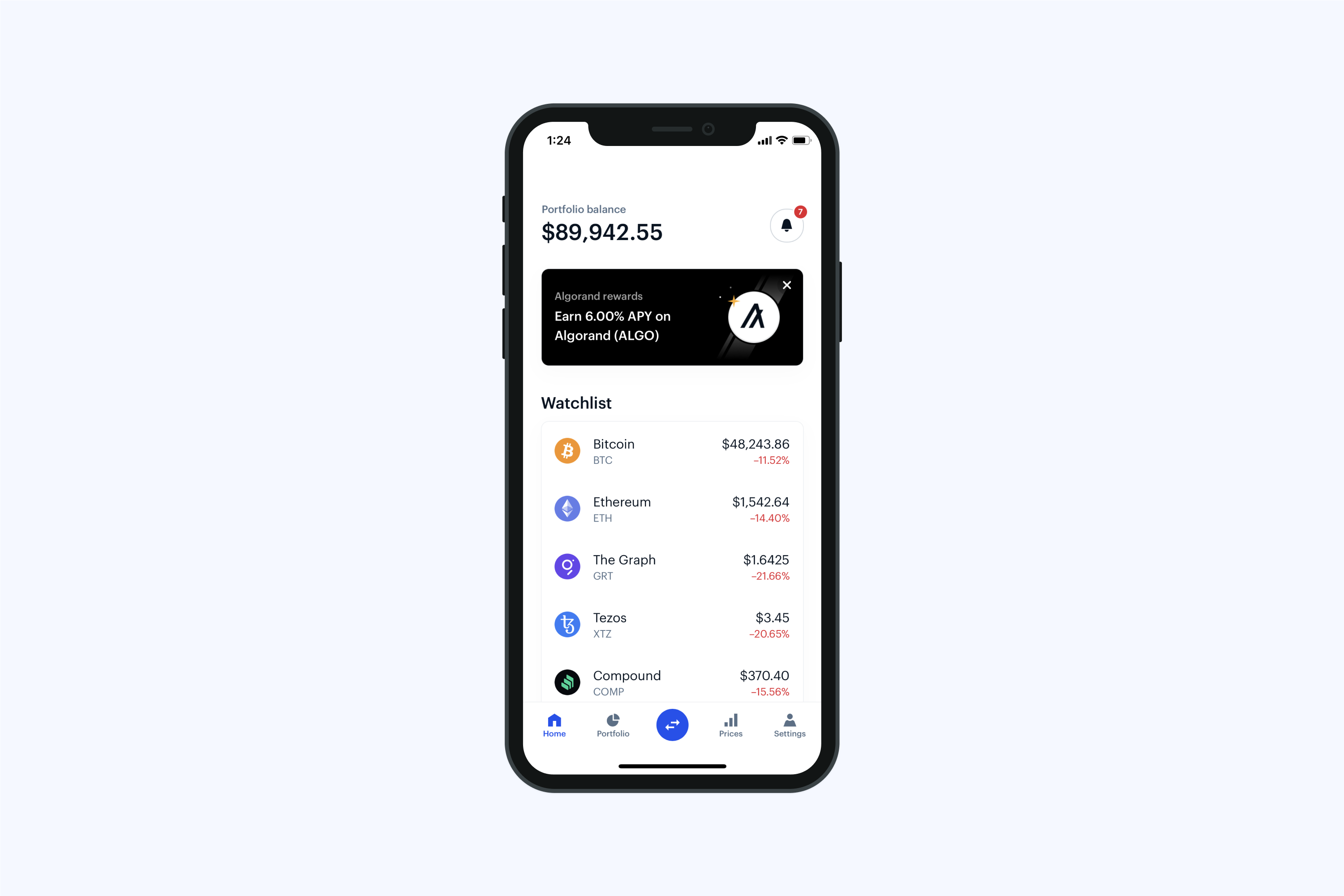

- Crypto wallets and exchanges are not only the backbone of this new financial system, but Coinbase specifically had emerged as the clear category leader. They had built large moats around their business with their brand, user-friendly interface and approach to regulation, among other things.

- Even at the Series D valuation, we felt confident that there was an opportunity that our investment would pay back the whole fund. Being a potential fund maker is one of our criteria for every single investment.

Looking today at Coinbase and crypto in general, our thesis has played out in the way we hoped it would: the market cap for crypto currencies has increased more than 12x since the fall of 2017, reaching over $2.2t in April 2021. Coinbase is the most recognized brand for crypto exchanges and the clear category leader serving both retail and institutional crypto investors. And, our investment ended up as a multiple fund maker.

Brian Armstrong and Fred Ehrsam started Coinbase with the goal of making crypto currencies accessible to the largest possible audience and creating an open financial system for the world along the way. Coinbase has stayed true to this mission over the years and built an incredible business at the same time. The IPO will now give more investors, who believe in Coinbase and its mission, the opportunity to join in the journey going forward.

But despite all of the progress that we have seen in crypto over the last few years, it is important to remember that crypto is still in its infancy. Relative to how the Internet developed, we might only be in 1997/98. So, the best is yet to come – for both crypto as an industry and Coinbase as an iconic company in this space.