Announcing our newest investment, Trim: A money-saving robot for the 99%

PortfolioLast week, in our blog post “Is Social Dead?”, we wrote about the excitement surrounding messaging as a platform/conversational commerce. But, we also cautioned that messaging isn’t always the optimal way to get things done.

One of the big unknowns is if the command line (or chat bubble) of a chat app is going to offer a better experience than an app. In some cases, the conversational approach of chat is the best solution for accomplishing a task; in other cases, it’s cumbersome and inefficient. After all, there’s a reason why we moved from DOS to Windows.

Conversational commerce might be best when 1) it’s a completely new use case (e.g. it’s not already defined like hailing an Uber), and 2) it’s not all that complex of a transaction.

These thoughts make the perfect intro to our latest investment, Trim, which we believe is ideally suited for conversational commerce. Trim has built a money-saving robot that starts by cancelling those unwanted subscriptions.

We’ve all spent money on subscriptions that we don’t need. In some cases, it’s due to procrastination (after all, companies make it much easier to sign up than to cancel their service). Other times, we simply forget about an old recurring payment as it quietly sneaks money away away from our account each month. For example, Trim co-founder Daniel Petkevich realized he was still paying renter’s insurance for an apartment he no longer rented. We’re all guilty of these lapses – no matter how financially savvy or responsible we might be.

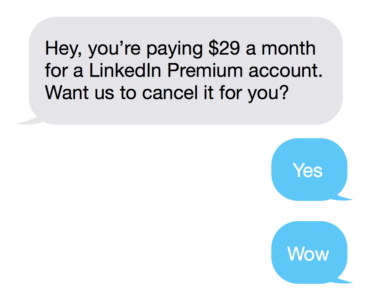

Trim removes all the friction from identifying and cancelling unwanted subscriptions. First, it pulls in your data from bank accounts/credit cards and identifies your subscription payments. It then sends you a text message of all your listed subscriptions followed by instructions on how to unsubscribe from those you don’t really want or use any more.

The simplicity and approachability of messaging are what make Trim work so well. There are no complex pie charts or long-term budgeting projections to pore over. Instead, Trim is more like a non-judgmental and really helpful friend who not only makes good suggestions but then can act on these suggestions (cancelling, negotiating, etc.) on your behalf. Going back to our thoughts about when conversational commerce is best: Trim offers a completely new use case and doesn’t involve that complex of an activity.

Co-founders Thomas Smyth and Daniel Petkevich think of Trim as a proactive financial advocate for the average consumer…aka the 99% of the population who don’t have accountants, financial advisors, or personal assistants.

Since Trim launched in November 2015, it has saved users more than $6 million in unwanted subscriptions alone. The average Trim user has 10 subscriptions and cancels two of them for an average annual savings of $383.

Trim is our first Fintech-related investment and we’re very excited about it. Since Mint launched in 2007, people have become more comfortable sharing financial information with a third-party / tech company. There are so many untapped opportunities in Fintech right now, particularly in building solutions for the overwhelming majority of people who don’t enjoy pie charts and have never had a financial advisor. Average consumers may have good intentions surrounding their finances, but they don’t always have the right tools or resources at their disposal to take the best actions.

If you’re interested, try out Trim: http://asktrim.com. You can also find them on FB Messenger as they are the first personal finance bot to be available on the platform.